Groupon: the Google of tomorrow?

Is Groupon, the fastest growing company in history, a giant of the future or a sign of a new internet bubble? Channel 4 News’ technology correspondent Benjamin Cohen reports from Chicago.

Groupon is a very strange sort of start-up. It’s not dominated by innovative technology, ‘campuses’ full of geeks, or losing shed loads of money.

It’s a company that is not just making extremely healthy revenues on high margins dominated by on-the ground not virtual sales people.

Its headquarters are housed in the building once occupied by Montgomery Ward, who launched the very first home shopping catalogue, Groupon may well prove as revolutionary for retail as them.

Andrew Mason, the company’s founder, was actually creating a website that facilitated online campaigning but turned it into a multi-billion dollar business.

It’s one of those really simple businesses that have had many people saying “why didn’t I think of that?”, and simply copying.

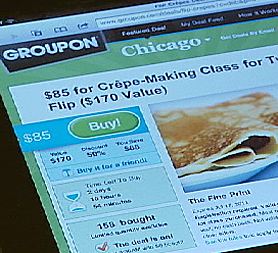

The idea is this, consumers ‘buy’ a discount voucher or coupon for fixed price; for example a haircut that would normally cost £80 for £25.

There have to be minimum number of people taking part in the deal, hence the ‘group’ part of the company’s name.

The need for enough people encourages those who want the discounted product or service to spread news of the deal to their friends via Facebook or Twitter. If that wasn’t incentive enough, Groupon pays you £6 or $10 for every friend you convince to take part.

What does Groupon get out of it?

Well they take half of the cover price. The merchants like it because they only pay Groupon for each genuine sale, they don’t have to pay them to appear on the website or for each person who clicks onto their listing as is the case with Google.

For a hairdresser who gives away a discounted hairdo, they’re using Groupon to fill excess capacity, hopefully cover costs and gain a relationship with new customers. Others like restaurants like Geja’s Fondue House who we visited offers a $60 discount voucher for $25.

They hope that not only that their customers buy more than $60 worth of food and drink and of course come back and pay full price in the future.

Groupon is so successful that is has probably become the most replicated business on the internet

Jeff Lawler, the managing partner of the restaurant told me: “We are advertising less in newspapers as a result of Groupon and Groupon like offers. I can measure their sales and discounts and I see that it’s working. When you do regular magazine or newspaper advert you just can’t measure it.”

All this is highly profitable and thanks to being spread virally via Facebook as well as an aggressive acquisition spree of rivals around the world Groupon has signed up more than 50 million users.

It now has almost five thousand staff in 40 countries and turned down a reported $6.6bn takeover offer from Google last year. More recently, the company raised $1bn on a $4.75bn valuation but many expect the company is worth significantly more.

Groupon’s revenue is suspected to be over $2bn a year, perhaps slightly higher than that of Facebook, which was recently valued at $50bn by Goldman Sachs and whose shares are trading in secondary markets at a $70bn valuation.

Groupon is clearly not as valuable as Facebook because it isn’t quite as sticky, but it is expected to float on the stock market at a valuation of around $15bn, an incredible amount for such a young company.

Groupon is so successful that is has probably become the most replicated business on the internet. Every city it operates in, and many more that it hasn’t yet reached have Groupon ‘clones’. The largest, LivingSocial is part owned by retail giant Amazon.

These businesses replicate every element of the Groupon concept, many seeming to literally just copying and pasting the iconic Groupon website design. One clone, in China is actually called Groupon, although I’d expect that to change when the real Groupon enters the Chinese market.

Facebook: the ‘story behind the story’

All of these rivals tap into Facebook to spread their offers and acquire users as Professor Andrew Razeghi, Kellogg School of Management told me: “If you grow that fast, you’re likely to be taken out of business just as quickly.

“Facebook is really the story behind the story, which is you have a pipe to get the word out and build a community. In the past, people were spending enormous amounts of money to acquire a new customer. Today it’s relatively cheap.”

Competition will force us to be better, there’s a big difference between us and Living Social. Groupon defined the space, Groupon has 50 million subscribers. Rob Solomon, Groupon president

LivingSocial this week showed how powerful an ally Amazon could be. LivingSocial’s Washington DC page sold $20 Amazon vouchers for $10. Available to all LivingSocial users around the world, the offer was taken up by 1,378,938 people. That’s more than three times more than the largest ever Groupon offer, of a Gap voucher.

Groupon’s president, Rob Solomon (pictured below right), told me that he wasn’t afraid of going head-to-head with a company backed by the leader in e-commerce.

“Competition will force us to be better, there’s a big difference between us and Living Social. Groupon defined the space, Groupon has 50 million subscribers.

“They are probably one tenth our size. Amazon investing them suggests to me that this is a very big important space.” He added that the Groupon and its rivals could be “a multi-trillion dollar part of the market”.

The reality is that the link-up with Amazon will certainly not harm LivingSocial although it’s not clear if the offer was gifted to them by Amazon or whether LivingSocial covered the loss in revenue for the retail giant.

Either way, the sector that Groupon is operating in is highly competitive or there are other questions worth asking about the business model.

Is Groupon a survivor?

For starters, some question whether the novelty will wear off. I get two Groupon emails a day with a number of offers, some interest me, and others do not.

At the moment, Groupon simply don’t know enough about me to ensure that the content on the emails are enticing. If they’re not then there’s a risk that I’ll unsubscribe or else not bother opening the email.

In its defence, Groupon doesn’t expect me to buy something from them everyday. If I did, then the novelty really would wear off and I would have more haircuts, foot massages and teeth whitening sessions than I could possibly handle, and I’m pretty high maintenance.

Another question is how sustainable is the relationship with the merchants. The Groupon concept is about bums on seats and for the merchants a hope that they will find new, regular customers.

Groupon has done something that is incredibly rare in the world of online commerce – it is profitable and has created a market that didn’t exist little more than two years ago

But the problem with Groupon is that it essentially forces you to ‘pimp-out’ your loyalty. If you’re a regular Groupon or Groupon clone customer, you’ll only want to pay 80 per cent off a hair cut, massage or restaurant meal.

Unless what you receive is exceptional at full price, why on earth would you come back? This is especially the case if you get 10 or so Groupon/clone newsletters a day all with offers for rivals.

Groupon told me that as it grows, it will know that I have just taken a haircut, so I won’t get sent a haircut offer for some time.

The emails it sends out certainly don’t have all the deals on offer in certain cities, but they are all available on their website. Because I’m also using all the other Groupon like services, the likelihood is that every week, I’ll receive a handful of offers all for businesses offering similar services.

Groupon users may also start to think that as a regular customer, the business you frequent is charging you too much, or at least artificially inflating the claimed regular price. Groupon say they police offers to ensure the later doesn’t happen.

Groupon also says that it is really picky about which merchants it will work with. One in seven get to run a Groupon offer, the rest are rejected and likely will go to their rivals.

A self service Groupon system is on offer for those who get rejected or who just want to promote Groupon like deals to their existing customers.

But they don’t have the exposure of the main Groupon service. Given that the technology is so simple, it doesn’t take a genius to use some simple software to offer a “Daily Deal” type email to all of your existing customers.

Other merchants have said that the economics just don’t work. They give so much away or get swamped with customers that they can’t handle.

I’ve had experiences on these types of websites of buying a voucher but never getting through to the company to book a haircut or whatever I purchased. Groupon say though that 94 per cent of merchants ask to run another campaign.

But I wonder if this could place a dangerous reliance on Groupon on the part of the merchant. If they can only get busy with the help of Groupon, their own businesses look shaky and there’s a danger they will be permanently dropping their prices.

Future float

All that aside, Groupon has done something that is incredibly rare in the world of online commerce – it is profitable and has created a market that didn’t exist little more than two years ago.

It has also cracked the way to get consumers to pay in advance online for offline transactions, guaranteeing revenue for high street merchants in a way never seen before.

If that wasn’t enough, it has tapped into the power of Facebook to make money for third parties on a scale that surpasses any other Facebook based business.

The last point, may be a negative though. Facebook is rolling out its own deals platform, based on where you happen to be when you logon to Facebook on a smart phone. Facebook has unrestricted access to the information it holds on its customers and the scale and trust of users to probably launch a realistic rival to Groupon.

It’s my bet that Groupon will have a successful IPO (initial public offering) on the stock exchange and will continue to grow. The fact that they have $1bn in the kitty thanks to some recent rounds of investment and is buying up rivals all around the world won’t hurt.

The money that it has in the bank, and the money it will raise through a flotation will help them adapt their business as the market and the competition evolves. Because they are cash flow positive, they may not fall into the same trap as the trailblazers of the past: Yahoo, Napster, MySpace to name just three.

Groupon is well aware of the risks, in its reception is a shrine to the fragility of internet businesses.

As you walk through the door, you see the cover of Forbes Magazine with a photograph of Groupon’s founder dead centre and the tag line “the fastest growing company ever”.

Around this magazine cover are those showing the founders of AOL, Yahoo, Napster and MySpace. Each of these covers depicts these websites as the next big thing. In reality they all failed and or significantly declined in value or influence. It’s a constant reminder to anyone (including – it was rumoured – Goldman Sachs CEO Lloyd C Blankfein, on the same day I visited) who enters Groupon’s office that overnight success can prove impossible to sustain.