Lift-off for ‘groundbreaking’ Boeing 787 Dreamliner

As Boeing rolls out its 787 Dreamliner, Channel 4 News asks if the new aircraft is truly “groundbreaking” and assesses its prospects ahead of the launch of the A350 by rivals Airbus.

Japan’s All Nippon Airways today takes delivery of the very first aircraft in Boeing’s Dreamliner 787 range. Next month the Dreamliner begins active service for the Japanese carrier.

Boeing says the aircraft, originally due to enter service in May 2008, will combine a better “flying experience” with a range of technological advances, including greater fuel efficiency and a smaller noise footprint. 25 per cent of the Dreamliner is built in the UK, including the Rolls-Royce Trent 1000 engine.

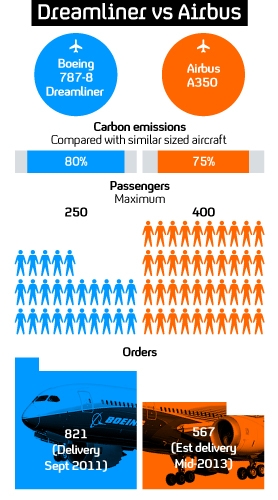

The Dreamliner has already secured 821 orders from carriers. From mid-2013 the US manufacturer will go ahead to head with the Toulouse-based Airbus, whose A350 is scheduled for delivery then.

A better experience?

Boeing believes the composite material that forms the basis for 50 per cent of the airframe will mean a reduction in fuel costs of up to 20 per cent.

The composite airframe should also offer a more comfortable cabin pressure. “When you’re flying at altitude, you have low pressure outside the craft, so you can’t pressurise the inside too much or you put too much strain on the aircraft,” explains David Kaminski-Morrow of Flight Global.

“With the 787’s composite make-up, you can essentially go a bit further than with previous aircraft in terms of how much you can pressurise the cabin. It means the atmosphere inside is closer to the atmosphere on the ground – which is what the body is used to.”

Boeing’s Blake Emery says the goal is “for people to feel better because of an aircraft experience, rather than feel beat-up”.

But will such innovation make a significant difference to the longhaul traveller’s experience? As aviation blogger David Parker Brown has observed: “Putting a few hundred people in a small space for more than several hours will always cause discomfort.”

Crucial delay

Despite being three years behind schedule, the 787’s delivery comes nearly two years ahead of that of its Airbus A350 rival.

“Airbus was slow off the mark, even by its own admission,” says David Kaminski-Morrow. “They didn’t anticipate how popular the 787 was going to be. In a way it’s a bit of good fortune that the 787 has been delayed – otherwise Airbus would have been potentially facing a much larger gap between the in-service entry date of the 787 and its own model.

“But I don’t think in the long term the difference in delivery dates will be crucial at all. The demand for the aircraft in that sector means that over the lifespan of the aircraft in question, a couple of years is not going to make much difference.”

Nonetheless, the Airbus, as well as being a bigger aeroplane, is significantly more expensive. The unit cost of an A350-1000 is put at $299.7m, compared to $218.1m for a Dreamliner 787.9.

And the former’s size will undermine its efficiency in covering longhaul routes. The 787’s long-range variant will be able to connect destination A to destination C without a stop at destination B.

But it is not clear which manufacturer will benefit in the long run from the 787-A350 cost differential. Some analysts suggest that in its effort to secure a pricing advantage, Boeing may in fact have sold off its aircraft too generously.