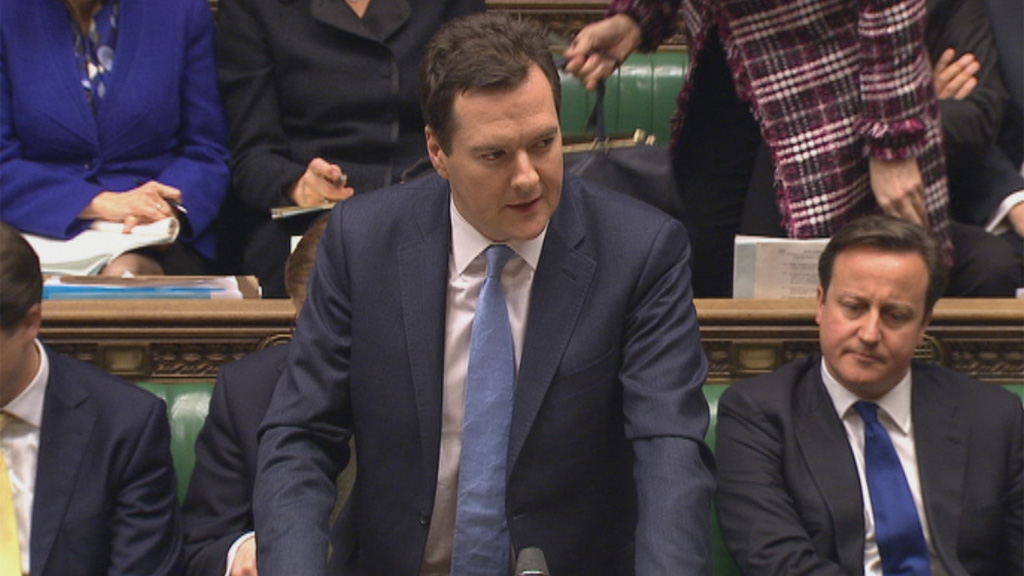

MPs warn Osborne over mortgage guarantees

George Osborne’s plans to boost home ownership risk harming the housing market and leaving the treasury with a significant hole in its coffers, a powerful committee warns in a new report.

MPs fear the chancellor’s decision to introduce mortgage guarantees makes the government an active player in the market with a financial interest in maintaining house prices.

The Help to Buy scheme is “very much work in progress” and is likely to have a number of unintended consequences, the treasury committee warned.

They included potentially landing the government with large losses on the mortgages it has guaranteed because the lenders fee structure it intends to put in place to cover the costs will be “extremely difficult” to price in a way that “sharply curtails exchequer risk”.

The government’s Help to Buy scheme is very much work in progress. It may have a number of unintended consequences. Andrew Tyrie, Treasury select committee

Publication of the report came hours after credit ratings agency Fitch stripped the UK of its AAA rating.

It is another blow in a grim week for George Osborne, during which the International Monetary Fund urged him to rethink his plans to reduce the deficit and official figures show a rise in unemployment.

In a critical report on the mortgage scheme, the committee said confusion in the days after the budget over whether the measures would allow people to buy a second home with government backing showed the need for ministers to “think schemes through carefully before announcing them”.

The MPs add that they “struggle to see the rationale for the taxpayer to stand behind loans for people wishing to own a second property”.

‘Unconvincing claims’

The intervention in the housing market may not even help first time buyers – the group the government insists it is keen to support – and Mr Osborne’s claim that increased demand will boost supply is “unconvincing”, the committee’s report on the budget found.

“There is a risk that if mortgage lenders begin to exercise reduced levels of forbearance, repossessions may rise and house prices subsequently lower than they would otherwise be,” the report said.

“If this happened, and unless this risk was fully priced into the fee, then the treasury could end up facing large losses on those mortgages it has guaranteed.”

Help to Buy consists of two elements, an “equity loan” scheme and the mortgage guarantee.

Under the equity loan new or existing homeowners will need to raise a deposit of five per cent of the value of the property they want to buy, but can borrow up to a further 20 per cent from the government on an interest-free basis. The biggest loan available will be £120,000.

The mortgage guarantee element will be available for all types of housing stock worth up to £600,000 from January. The government will guarantee up to 15 per cent of a mortgage, allowing people with 5 per cent deposits access to lending.

‘Immense’ pressure to extend scheme

The committee warned the government will come under “immense” pressure to extend Help to Buy in three years time.

It said: “The unintended and unwelcome outcome could well be that a scheme designed to deal with a supposedly temporary problem in the UK housing market becomes a permanent feature of the UK housing market.”

It adds: “Overall, though, if the government’s priority was housing supply, its housing measures should have concentrated there.”

The committee lists a raft of questions it says the government must answer to “allay concerns that the scheme may have unintended and unwelcome consequences”, including what predictions it has made about the impact it is likely to have on house prices.

Committee chairman Andrew Tyrie said: “The government’s Help to Buy scheme is very much work in progress. It may have a number of unintended consequences.

“Without further detail it is not possible to estimate its effects. The questions the committee has asked the government need answering.”