No pain, no gain, in Ireland’s 2012 budget

As Ireland negotiates its way out of recession, Channel 4 News hears that the fourth austerity budget in four years will take its toll on an already fragile country.

On the day of the second instalment of Ireland‘s 2012 budget, one taxi driver is already taking precautions.

“He told me he would try Dublin to get alcohol in before Christmas, but failing that, he’s taking a trip to Newry [in Northern Ireland],” said Macdara Doyle, spokesperson for the Irish Congress of Trade Unions (ICTU).

Mr Doyle’s taxi driver will not be the only one considering a pre-Christmas shopping trip across the border.

Following the first part of Ireland’s 2012 budget, which aimed to cut 1.4bn euros from public sector services, the minister for finance has now outlined how he plans to save another 1.6bn euros from additional tax revenue – including a rise of VAT to 23 per cent.

I know of examples where teachers buy classroom resources from their own pocket because school resources have simply dried up. Peter Mullen, INTO

The ICTU represent 850,000 unionised workers across Ireland – around 620,000 in the Republic – and Mr Doyle told Channel 4 News the rise of VAT will heavily impact the cross-border community.

“Retail is bad enough hit as it is, but those in the border areas really have to worry about cross-border impact. Even the psychological effect could drive people across,” he said.

“With a double whammy of petrol and alcohol price rises, with the VAT rises, Wednesday morning could be very busy in Newry.”

Eurozone problems to blame

This is the first budget from Ireland’s new coalition government, the election of which saw Fianna Fail suffer a staggering defeat at the hands of voters.

However the new coalition’s honeymoon may be over with this new budget aimed at saving 3.8bn euros to bring the deficit down to 8.6 per cent of GDP.

Around 60 per cent of the deficit reduction will be made through from savings of government spending in health, social protection and education, while the remainder, announced today, will be made through indirect taxes.

Twelve months ago we were Europe’s problem. Now problems in the European and global economy threaten our recovery. As a Labour minister I never expected that I would be making the type of announcements I am making today. Brendan Howlin, Minister for Public Expenditure and Reform

Speaking at the Dail on Monday, the minister for public expenditure and reform, Brendan Howlin, said that the eurozone crisis had a huge bearing on the 2012 budget.

“Twelve months ago we were Europe’s problem. Now problems in the European and global economy threaten our recovery.

“As a Labour minister I never expected that I would be making the type of announcements I am making today. We have been forced to make difficult and unpalatable decisions.”

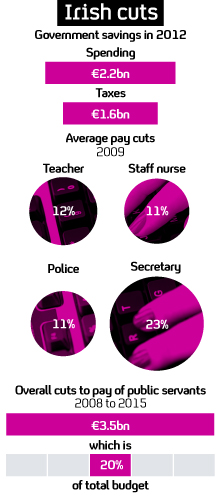

Public sector workers have already been faced with significant pay cuts [see graphic, below]. The Croke Park Deal of 2010 protects current public sector workers from further pay cuts until 2014.

‘Unprecedented’ cuts to frontline health services

However, a hiring freeze in parts of the health service has resulted in a reduction in staff, according to the Irish Nurses and Midwives Organisation, who say that the health service has seen a loss of 3,100 nursing posts over three years.

No nurses were available to talk to Channel 4 News because they are simply too busy to step out of the ward, said a INMO spokeswoman.

INMO General Secretary, Liam Doran said that the fourth successive year of cuts to the health service is “unprecedented within the OECD”.

“The failure of the government to bring forward the protections for frontline services it spoke about so often when in opposition, must be challenged,” he said.

“No amount of redeployment or reconfiguration can maintain services in the face of a continuing wave of unmanaged cutbacks.”

The Irish National Teachers Organisation (INTO) said that parents and primary teachers would be relieved that in the majority of cases, class sizes would not rise, with the teacher/pupil ratio largely staying the same. But Peter Mullen told Channel 4 News that because schools are mainly run privately by church parishes or supplemented by parental funding, resources are thin on the ground.

“For much of the last 15 years, parents were quite willing to do that, but that has changed and there’ll be a big difference between affluent and more disadvantaged areas,” he said.

“I know of examples where teachers buy classroom resources from their own pocket because school resources have simply dried up.”

Government ‘preparing’ people

The current government has tried to be transparent and to take the people with them as much as possible, Joe Tynan, international tax partner at PwC told Channel 4 News.

“If you look at the overall perspective, this government has certainly made a much greater effort to communicate with the people,” he said.

“Enda Kenny [prime minister] made a national address on Sunday night to prepare people for what was coming.”

Ireland’s exports have been growing over the last year, and the government has protected this area to generate growth, and will instead tax consumer spending.

However Ireland still has to pay off the 85bn euro it paid to save Anglo Irish bank – a source of grievance for many. Unemployment is also a huge concern, with conservative estimates putting it at 14.5 per cent, despite an exodus of 40,000 people in 2011 alone.

Whether the 2012 budget can keep Ireland’s fragile economy on track remains to be seen. But in the short term, it will take time for individuals to be relieved of the burden.

Mr Tynan added: “You cannot take 3.8bn euros out of an economy and expect it not have an impact.”