Top tips for savers

The day after the Bank of England’s Deputy Governor told Channel 4 News that savers should be eating into their capital we hear from one expert on how best to preserve your pot of money.

Times are tough for Britain’s savers.

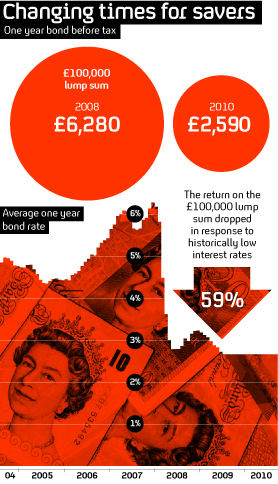

The base interest rate has been kept at 0.5 per cent for a year and a half.

The lowest rates in history mean that people who have been prudent with their money are seeing shrinking returns.

The Bank of England’s Deputy Governor, Charlie Bean, told Channel 4 News Economics Editor Faisal Islam that savers should not see themselves as being uniquely hit.

“I think it needs to be said that savers shouldn’t necessarily expect to be able to live just off their income in times when interest rates are low,” he said. “It may make sense for them to eat into their capital a bit.”

But there are a variety of options for people with savings according to financial experts.

David Kuo is director of the financial website, The Motley Fool. He told Channel 4 News he could see both sides of the coin: “Two thirds of the UK economy depends on people spending money so if people don’t spend money the UK economy will shrink.

“But I think somehow Charlie Bean doesn’t appreciate the problems some people are in at the moment. There are many people out there who are very concerned about the future.

“They are worried about their capital and what they are really concerned about right now is how do I make sure I have enough money next year in case something were to happen.”

Savings: Mr Bean was blunt, but he should be thanked.

There is something of a media storm over Charlie Bean's interview with me.

I wasn't entirely convinced that Britain's savers would take Charlie Bean's comments in the way that he probably meant them. For a start, his points seem to have been slightly inflated by our friends in the newspaper headline writers' guild. He did not go as far as saying 'Spend for Britain' or 'Spend Spend Spend' of 'Savers Stop Moaning'.

In his interview with this programme, broadcast last night, he suggested that 'in the short term' households spending 'a bit more' could help boost the economy.

Read full article on Faisal Islam's blog

Bean counter Charlie

Who Knows Who looks at the 'pointyheaded' economist who Mervyn King went to battle over with the Treasury over his appointment two years ago. King balked at the idea of promoting someone with City clout - fighting the Treasury's hopes for someone keenly focused on the financial markets. All of which was a bit of a headache for then-Chancellor Alistair Darling.

Read more: Bean counter Charlie

Following Charlie Bean’s comments Channel 4 News asked David Kuo for his top tips for people with savings: “There are various things that are concerning people at the moment if anything was to happen to their job security. As far as these people are concerned one of the best things they could do is pay off their mortgage.

“If you had £1000 – rather than put it into a savings account where you’re earning very little interest – you could pay down your mortgage.

David Kuo’s second tip is to lock away money for longer: “The banks need cash so if you’re prepared to commit your capital for three to five years you’ll get slightly better interest than leaving it in an instant savings account but you have to be aware of inflation.

“The interest rate that you’re earning on these medium term bonds may be high but you have to remember inflation is also eating away at capital at the same time.”

Next on the list of top tips is ISAs: “Individual savings accounts, now they were created by the Government to allow people to save without paying tax on the interest they earn on their savings account.

“So if you have got money in an ordinary savings account somewhere then think about switching it to an ISA.”

David Kuo’s fourth top tip is buying a basket of commodities: “One thing we’ve heard about quite often in the news is inflation. We hear about many high street retailers threatening to increase prices this time next year because of higher cotton prices. All this points to higher commodity prices. We hear that gold is now reaching $1,300 an ounce, wheat prices are going up, food prices are going up.

“So one thing people can do if they want to take that little bit more risk is to invest in a basket of commodities. This avoids the need, for instance, to have a bushel of hay in your back garden or a barrel of oil..you can do this quite seamlessly by tracking commodity prices and this is one way in which you take advantage of higher inflation which is going to be happening.”

The final top tip is investing in shares: “High yielding shares sounds a little bit technical but ultimately it is a percentage of the profits that many of the companies that you’ve heard of before are paying to share holders.

“Now currently the yield on many of the high yielding shares is around 5 or 6 per cent which means that if you invest £100 you get £6 in dividends every year. This is about twice the amount you would get from a normal savings account. It is more risky but if you buy a basket of these shares it helps to moderate the kind of risk you’re exposing yourself to.”