Young people giving up on home ownership dream

The dream of owning their own home is fading for many young people in the UK according to a new study.

The survey of 8,000 first-time buyers, which was carried out for Halifax, found that most people questioned still hoped to get onto the property ladder but 64 per cent of them said they thought there was no prospect of them ever being able to do so.

The lender’s survey also found that there was a widespread perception that banks would be reluctant to give them a mortage as 84 per cent thought that banks did not want to advance money to them to buy a home.

Generation rent

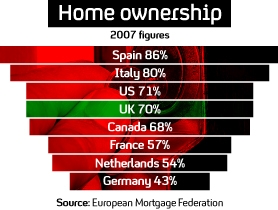

For those who are likely to have to rent for longer, just under half believe that the UK is becoming more like mainland Europe where they think renting is the norm.

Alison Blackwell from the National Centre for Social Research which carried out the survey on behalf of Halifax said: “The phenomenon of ‘Generation Rent’ could have major socio-economic implications.

“It would mean fewer homeowners being able to buy, and therefore fund, the construction of the new homes required in the UK to meet demand, resulting in a slowing-down in the housing market.

“It could open up a widening of the wealth gap that already exists between homeowners and non-homeowners. And people in Generation Rent risk insufficient finances at retirement.”

Is renting the ‘norm’ across Europe?

The perception that renting your home is more common on mainland is not true. The majority of people in Europe are owner-occupiers and countries such as Germany and Switzerland which have a lower incidence of home ownership are the exception rather than the norm, according to a report from the Joseph Rowntree Foundation.

How to boost your chances of getting on the housing ladder

– Get a copy of your credit report and if necessary take steps to improve it such as ensuring you are on the electoral roll.

– Shop around and use mortgage calculators to find the best deal.

– Ensure you consult an independent mortgage adviser. You can find a list of them on the Unbiased website but ensure you do your research beforehand as some deals are only available directly from lenders.

– Check out government run home buying schemes which can include either getting an equity loan or buying a share of a new build home while paying rent on the remainder.

– If you are over 55, you may be able to buy a home through a special home buying scheme for elderly people called ‘Shared Ownership for the Elderly’

– Get help from parents or relatives (ensure you take legal advice to avoid problems later).

Join in the conversation on Facebook facebook.com/channel4news and Twitter @Channel4news

@Caroline Quane The real problem is that in this country tenants have limited rights and renting is hideously expensive as everything is weighted in landlords favour. Attitudes need to change but that is unlikely in a society obsessed with property ownership. I speak as a former home owner and now tenant!

@John Stansfield Property ownership is over rated. People who say it's better to own because you don't get a return on rent payments are missing the point. Your 'return' is the roof over your head that the landlord provides. Hocking yourself into decades of potentially horrendous debt is madness.

@RubyKay When I see people in cardboard boxes & doorways sleeping rough, I'm just grateful I have a home! Who cares about owning it :/

@Jennie_Kermode It astounds me that the home ownership issue is news. Lots of people in UK worry about next meal, not prospective mortgage.

@Jan Bird not important at all. I rent, always have done. I don't see any stigma in it. I've never earned enough, and it's never bothered me.

@Yannick Hans the moaners from the UK should visit countries in south america or eastern europe where mortgage rates are 4-5 times higher than in the UK, people hardly earn enough to get by each day and mortgages are near impossible to come by...