Why growth matters

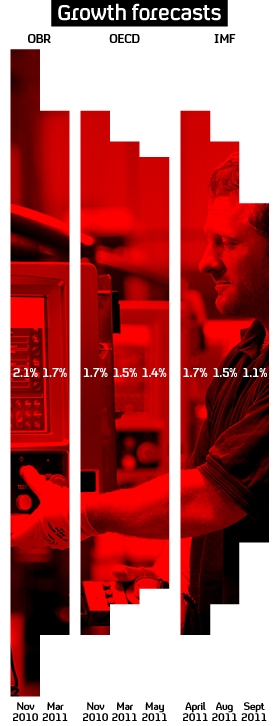

As the IMF cuts its growth forecast for the British economy, Channel 4 News explains what it means for our money.

In normal times, economic growth is seen as a good thing because it leads to higher standards of living.

This is particularly important at the moment because of the imbalance between tax revenues and public spending, a gap filled by borrowing. The government needs to close this gap to ensure Britain is living within its means.

If growth rises, incomes increase, along with tax revenues. If growth stalls, the government has to takes more money from people in taxes and/or cut public spending.

Another effect of lower growth is a rise in unemployment and more spent on welfare benefits.

The government has embarked on an £81bn programme of spending cuts and tax increases. If growth rises more slowly than forecast, the government’s figures may have to change.

The Treasury’s rule of thumb is this: for every 1 per cent of growth lost, in the current year, public spending as a percentage of gross domestic product will be 0.4 per cent higher and tax revenues 0.1 per cent lower.

In other words, lower growth leads to higher public spending, funded by higher taxes and/or higher borrowing. If lower growth is only temporary, the government’s plans are not affected. If it continues for several years, the loss of tax revenue would be significant and ministers would have to look again at their plans.

Read Faisal Islam's blog: IMF takes a knife to forecasts for UK growth