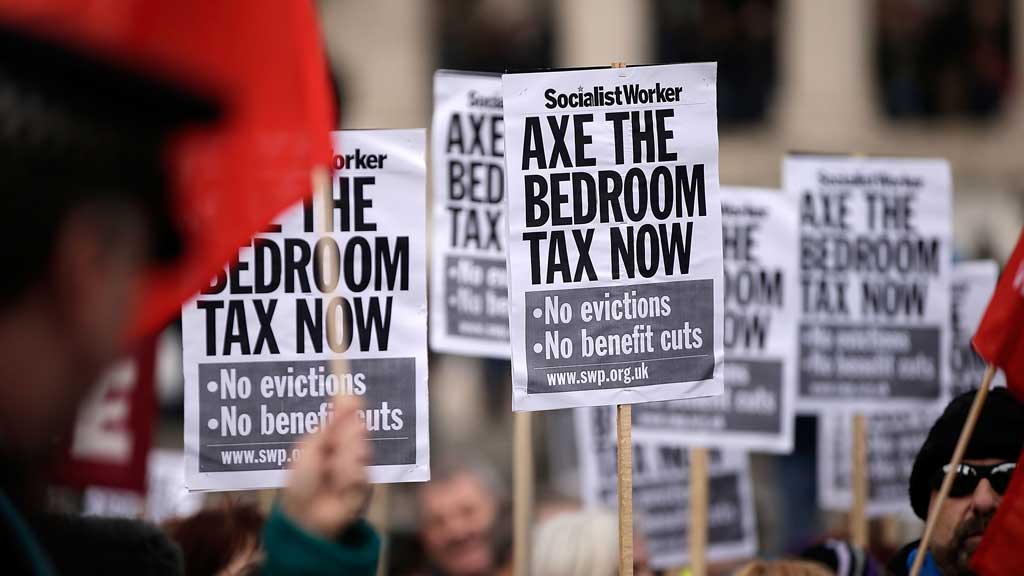

‘Bedroom tax’ – one year on, is it working?

It is 12 months since the government removed its spare room subsidy, dubbed the “bedroom tax” by critics. It is designed to save money and free up under-occupied homes, so what effect has it had?

Scrapping the spare room subsidy, which applies to working-age tenants in social housing who are claiming housing benefit, is supposed to ensure that people are not living in bigger homes than they need at the taxpayer’s expense – at a time the government is looking for savings from the welfare budget.

People deemed to be doing so have a choice: they can move to a smaller home or pay more rent.

Polls show the government’s welfare policies are popular with the public. The problem is that finding a smaller home in the social housing sector is not easy – there is a lack of availability – so most people affected have had to find more money.

Benefit cuts

In May 2013, a month after the “bedroom tax” was introduced, the Department for Work and Pensions (DWP) estimated that 660,000 people would face a reduction in their housing benefit because they had at least one spare room.

By November, the department produced new figures showing that 498,000 were affected by the changes. This is a fall of 50,000 from the initial estimate, which the DWP attributes to people taking action, such as moving to a smaller home, finding work, increasing their earnings, and/or discontinuing their claim for housing benefit.

Channel 4 News asked the DWP what had happened to all social housing tenants living in homes with excess bedrooms. Were they paying more rent? How many had moved? The DWP said it did not have any published data which could answer these questions.

‘Little research’

An impact assessment drawn up by the DWP in 2012, before the policy was implemented, said “there is little research that provides an indication about the possible behavioural impacts on claimants in the social rented sector following the introduction of the size criteria”.

But it added: “DWP estimates that the impact of claimants moving to smaller accommodation, (as opposed to remaining in their current accommodation), is likely to be broadly neutral in terms of the impact on benefit savings.”

This suggests that although the government could not be sure how people would react when the spare room subsidy was removed, it expected to make most of its savings from people staying put and paying more rent rather than moving to smaller, cheaper accommodation.

The government’s rationale is that before the reforms, a million spare bedrooms were being paid for by the taxpayer, despite the fact that there are a quarter of a million households in England living in overcrowded social housing and another 1.7 million on waiting lists.

Then there is the small matter of austerity, with ministers expecting to save £1bn over the next two years.

The 'bedroom tax' - the key questions

People caught out who decide to stay put, or cannot find a smaller home, face a 14 per cent reduction in their housing benefit if they have a spare room, or 25 per cent if they have two or more spare rooms.

So what has happened since April 2013? The National Housing Federation (NHF), which represents two thirds of housing association homes in England, published a survey in February which showed that two thirds of households hit by the changes were in rent arrears, with one in seven at risk of eviction.

The Ipsos MORI survey of 183 housing associations found that more than a third of those in arrears were in this position because they could not afford to pay the “bedroom tax”.

‘Misery and hardship’

According to David Orr, chief executive of the NHF, removal of the spare room subsidy is “heaping misery and hardship on already struggling families”. Although the government argues that people affected can move, “we know there aren’t enough smaller homes in England for these families to move into”.

The DWP is aware of these shortages. Its 2012 impact assessment said there was a surplus of three-bedroom homes and a lack of one-bedroom properties, which “could mean that there are insufficient properties to enable tenants to move to accommodation of an appropriate size even if tenants wished to move and landlords were able to facilitate this movement”.

The Local Government Association (LGA), which represents councils in England and Wales, says the “limited opportunities” for tenants to downsize is driving up local authorities’ costs.

The government is helping people affected by its welfare reforms with its discretionary housing payments fund, which allocates money to councils, and the LGA says the end of the spare room subsidy is “the biggest cause of financial hardship among those applying for help”.

It also argues that demand for help “is significantly outstripping the money the government has made available to councils to mitigate the changes in some areas”.

In August, a study commissioned by the LGA estimated that benefit cuts, combined with a shortage of jobs and affordable homes, would mean that “four out of every five of those households are likely to need some form of assistance from their council to help them cope with the reduction in welfare”.

(UN official Raquel Rolnik, a critic of the “bedroom tax”, debates with Conservative MP Nadhim Zahawi on Channel 4 News in 2013)

The Scottish Federation of Housing Associations says the reforms are increasing costs for social landlords because of the resulting rent arrears and additional expense involved in advising and assisting tenants.

This, it believes, will push up rents, increase the housing benefit bill and ultimately cost more than the government hopes to make in savings.

BBC research published on 28 March showed that just 6 per cent of social housing tenants affected by welfare changes had moved home.

The DWP responded by saying removal of the spare room subsidy was saving taxpayers more than £1m a day.

A DWP spokesperson said: “Just a year ago, the taxpayer was being forced to spend over £1m a day for spare rooms in social housing – while hundreds of thousands of families were living in cramped, overcrowded accommodation.

“Our reforms help ensure we make better use of our social housing stock, and we are providing councils with £345m across this year and next to support people through the changes.”