Banks: one step forward, many more to go

The washing of filthy linen continues apace in the City’s square mile. Battered Barclays has now added yet another $1bn to the sums having to be set aside for mis-selling of interest rate swaps and PPI.

Other banks aren’t so lucky. Other banks – including our taxpayer-owned entities – are much more exposed to the interest rate issues and will have to set aside far more.

Amid the slurry of excessive bonuses and the exploitation of unsuspecting small and medium-sized businesses, desperate to secure investment loans and being skinned for doing so (via those interest rate swaps), the government has had a dramatic change of heart.

Ever since Sir John Vickers report on banking reform, there has been ferocious political resistance to his recommendation that retail and casino banking be separated. After all, the 2007-8 financial meltdown was in a large measure a result of nation states having to bail our entire banking sectors precisely because banks had gambled with their retail customers’ cash. Hence the need to bail them out. No government could stand idly by whilst millions of citizens lost everything.

Intriguingly, public revulsion against the banks, which has built by the day, has had its affect upon the political classes. It is proving a rare and fascinating moment. In fact I find it hard to find a parallel in our recent political history.

The chancellor’s original response to Vickers was to “ring fence” retail from casino banking. Yesterday, Chancellor Osborne announced “the electrifying of the fence”. Electrification gives the Bank of England – now the bank regulator – the power to order the break-up of any bank found gambling with retail customers’ cash. In other words, an admission that banks still cannot be trusted to respect a fence. Trust now has to be enforced by law.

With legal cases on almost every continent – with the implications of the Libor interest rate fiddling by bankers still posting unquantifiable amounts of liability for virtually all the banks, and with mis-selling consequences also unquantifiable – whatever individual banks may THINK they are, we are still at the beginning of resolving this element of the banking crisis.

Plight of small businesses

In the meantime let me finish with the case we highlighted on Channel 4’s Dispatches last year. The Harrison family have run a brilliant business making advertising signs – “For Sale” signs and that sort of thing. Over time mum and dad retired in their late sixties and the next generation took over, employing perhaps 10 workers at premises in south London.

In 2006 they went to the bank for a loan to enable them to expand and embrace new printing technology. The bank gave them the loan but insisted the business took out an interest rate swap. They were told they had to take it on or wouldn’t get the loan.

The sheer costs of servicing the swap all but overwhelmed them. Workers had to be laid off. Mum and Dad by now in their seventies, and Mrs Harrison far from well, had to come back to work for nothing. The bank only stopped forcing them to pay the charges on the swap last November.

How are they ever to be recompensed for the hundreds of thousands of pounds they have lost, let alone the grief and socio-economic pain and loss they have suffered. How do you cost that?

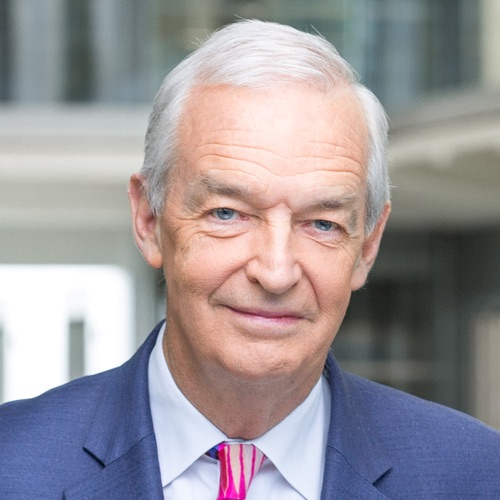

Follow Jon Snow on Twitter