Amid the Barclays scandal: the test of true reform

The shock of the Barclays scandal and the increasing evidence that other banks were involved in lying about the true interest rates that they were charging is not subsiding. The shock waves are rippling across every facet of City life.

The revelation of the ‘old boy’ network that was engaged in sorting out an agreed daily interest rate has shone a light on all sorts of other similar practices in the Square Mile. The reputation of the British Bankers Association has been brought low; the credibility of that agreed interest rate the Libor, has been traduced; the reputations of the mega forces at the top of British banking are on the floor; and confidence in the regulatory forces at the Financial Services Authority (FSA) and the Bank of England are also in question.

That’s before we ask questions about the apparent inactivity of the Serious Fraud Office and the ‘law’ in general. That’s also before we question the response of the political classes who seem to be attempting to mud-pie each other whilst the City burns.

It’s hard to imagine that Wall Street is not already ringing to the sound of office laughter. For years Wall Street has watched its work leeching away to ‘light touch’ London. Over the past decade, the City of London has become the financial capital of the world. Current events look like threatening the prospect of such an epithet being conjured again any time soon.

Whilst Barclays and others chuck emails and memos about in the hope of compromising UK regulators, we are in danger of evading the central question ourselves. How was it that so sophisticated a US Department of Justice investigation was able to achieve what our own regulators had so signally failed to do? The US had investigated, prosecuted, fined, and virtually sealed the deal with Barclays with very much greater alacrity than the FSA

The two cases either side of the Atlantic may have looked as if they ran in tandem but sources to whom I have spoken say that the FSA trailed the US authorities in time, energy, and scale. Does that suggest that America was in some way more scandalised by what they found, that the UK might have been a tad more complicit? We will not know until a proper investigation unfolds here.

Those who believe this will prove the great moment of change in City practices may be disappointed. Financial services have replaced manufacturing in providing the backbone to the UK’s gross domestic product. It depends on many of these ‘wild west’ activities. Globalisation ensures that ‘turbo charged capitalism’ will be conducted somewhere anyway – so why not here?

The UK’s holy grail of banking reform resides in the pages of Sir John Vickers’ banking review. But events have put his support for ‘ring fencing’ – that is separating retail from casino banking but keeping them under one roof – under immense pressure. If the Barclays scandal tells us anything, then it is that when a banker sees a ring-fence, he or she will either seek to climb over it, cut through it, or dig beneath it.

The test of true banking reform is likely to reside in whether the political classes actually break the banks up – separating casino and retail completely. Don’t hold your breath for such a move.

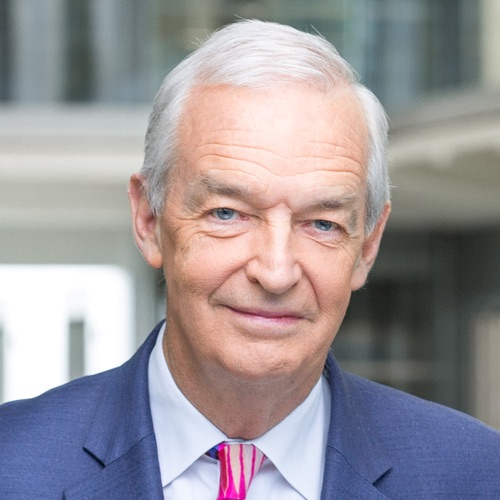

Follow Jon on Twitter via @JonSnowC4