Betting on junk

The FT this morning tells us the junk bond high-risk investment market is back – signalling a boost in confidence. Is a junk bond as junky as it sounds? Apparently it is.

There’s a lot of investors out there, we are told, who are awash with cash and need to put it somewhere, so high yield junk is where it’s going. Very often the investor has no idea what these products consist of – frequently, good debt wrapped in bad debt – bad debt wrapped in good. But, says the FT, investments in this area are up 1.3 per cent. Safer investment in more tangible stuff is down 0.15 per cent.

Has the world moved on? Wasn’t this the market that heralded the worst financial melt down in anybody’s lifetime? How much has really been done to secure all our tomorrows against ‘bubbles’ and worse?

Only last week it was announced that the Basel 3 rules, that were designed to force the banks to recapitalise, were relaxed – the timetable for completion slipped to 2019, and the sums were eased too. All this to allow more investment in growth. But most of the cash that had been going into bank re-capitalisation had anyway come from the Bank of England or, in the US, from the Federal Reserve in the form of QE – quantitative easing. Now QE seems to be going out of favour – it had really been intended for re-booting the economy in jobs and products. It failed to produce much of either.

So now we have turned back to the markets, and junk. Our retail banks into which everyone one of us puts our wages are still hopelessly, and perilously entwined with casino banking which we now see is joyfully entwined with betting on junk bonds.

Shall we run a book on how soon the whole horrible edifice blows up? Someone might make even more than by betting on junk.

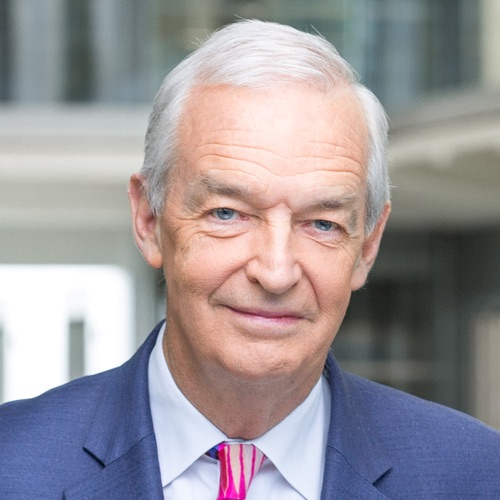

Follow @jonsnowC4 on Twitter