Dirty banking still a problem

The extraordinary telephone conversation between two executives from the Anglo Irish Bank at the height of the 2008 banking crisis gives us the most diabolical and poignant insight into the behaviour of the sort of people who got us into our very present and harrowing financial mess.

The jocular exchange, the random 7bn euros demanded for the bank’s bail out, tell us more than we dared fear.

These guys appear to be cowboys, playing fast and loose with other people’s cash and lives.

In the end they effectively bankrupted the Irish financial system. They were not alone. The City of London had its own posse of wild horsemen.

All these months, and now years on from the crisis none of them has been brought to book.

Many indeed are still more than afloat on their own winnings from their gambling that left the rest of us so very deeply in debt. We shall feel it today as the chancellor sets out the nearly £12bn he’s cutting from public spending.

This self same chancellor has played his part in attempting to reorder our regulatory framework to try to ensure that such apparently wayward and destructive behaviour never takes hold of our financial lives again.

But in his very final public utterance before he leaves the Bank of England next week, Sir Mervyn King, the governor, has exposed an undermining track that leads right to the door of George Osborne’s neighbour in Downing Street.

One of the key ingredients of the financial meltdown rested on the banks’ under-capitalisation.

Couldn’t save their own bacon

They just didn’t own a high enough percentage of cash to save their own bacon in a crisis. The Bank of England has gradually forced the banks to increase that ratio.

For some banks it has been far from painful. The billions of pounds worth of cash the bank of England has been throwing at the economy – “quantitative easing”, has almost all been siphoned off by banks to increase their capital. In short, we have recapitalised the banks out of our own pockets.

But now “quantitative easing”, is being closed down. Despite that, the Bank of England is demanding further re-capitalisation continues – and rightly so.

The smash-up on the Chinese stock markets is one of many signs of the rocky times around the corner. So without “quantitative easing”, the banks are having to find the money for recapitalisation, for themselves.

Sir Mervyn told MPs yesterday that this has triggered a new and insidious traffic of bankers to the prime minister’s back door. The bankers are tapping up back benchers to pressure the prime minister to get the Bank of England to ease the pressure on them.

Poignantly, Sir Mervyn finished his final appearance at the Commons yesterday by warning MPs against lobbying for the banks.

He added that neither did he think the banks should conduct conversations with supervisors through the front pages of the Financial Times.

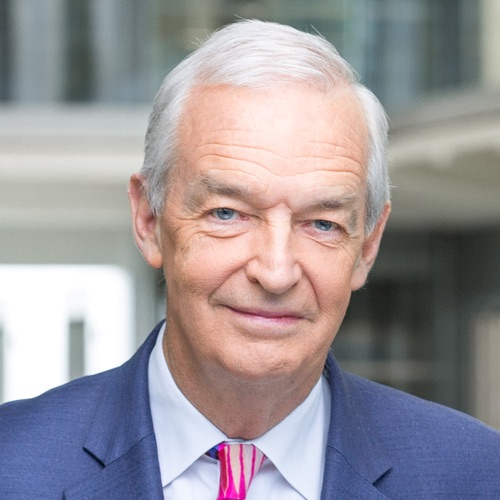

Follow @jonsnowC4 on Twitter.