Feeling sorry for Stephen Hester?

Does one feel sorry for Stephen Hester? You may see this as a useless and irrelevant question. But when Labour got into the business of bust banks, ministers found that if they were to save the accounts, savings, mortgages, and investments of millions of taxpayers, they had to adopt the mechanisms and practices that in public, they said they most abhorred.

RBS already had Fred Goodwin to drag about the streets for taxpayers to throw rotten fruit at. But having sacked him they urgently needed a believable figure to drag the bank out of what was now a taxpayer-funded mire. The coming together of the state and RBS was the most emergency of shotgun weddings. There was neither the time nor the inclination to use RBS as a new model of moral banking and someone had to do the filthy job of sorting it out.

Send for Stephen Hester! Here was a former chair of the Tory Reform Group, a seasoned banker with top posts in Credit Suisse, and Abbey National, that Labour had already tapped to help out at the equally bust Northern Rock in March 2008. By November 2008 he resigned from that and had taken charge at RBS.

More from Channel 4 News: RBS’s Hester waives £963,000 bonus

Labour breathed a sigh of relief that at least one credible banker had assisted the taxpayer in preventing one of the world’s biggest banks from going bankrupt and triggering misery on a banking scale unseen since the Great Depression.

The shotgun was so heavily loaded, and so imminently in danger of going off, that the Labour government had to sign a pretty conventional contract with Mr Hester. It had to be adorned with bonuses, which were attractive enough to extract him from the safer pastures in which he had previously grazed.

Move to last week. Mr Hester is attacked left, right, and centre for daring to consider requiring his employers to honour his contract – a contract drawn up by the Labour government. When it looked as if he would take the money, who better than the very people who had written the contract, the now Labour opposition, to cry foul.

Ministers do not boast much about the state of our bank. They don’t tell us much about how much less bust it is today than it was. But by all accounts, Stephen Hester has fulfilled his side of the bargain – shed vast elements of RBS’s balance sheet that should never have been there in the first place. He is reportedly making progress in getting the bank into some kind of long-term shape.

There are others in his team getting huge bonuses, traders for example. But they are traders who could do the job somewhere else. RBS is still in danger; it would still be bust were it not for us. It is having to deploy the same mechanisms that are enabling other banks to cut a profit.

It’s no secret that there is something rotten in global finance global and UK finance. Vast reform is required. In the meantime the financial well being of millions of account holders, savers and investors at RBS have to be protected. Mr Hester is leading that protection.

As the prime minister has mentioned, if Stephen Hester goes, it won’t be easy to find a replacement. It’s terrific fun trying to reduce a banker to the gutter. In Mr Hester’s case – rich though he may be -the mess is ours not his. All the ingredients for another financial failure are in place. Detonating Mr Hester’s persona will do nothing to resolve that.

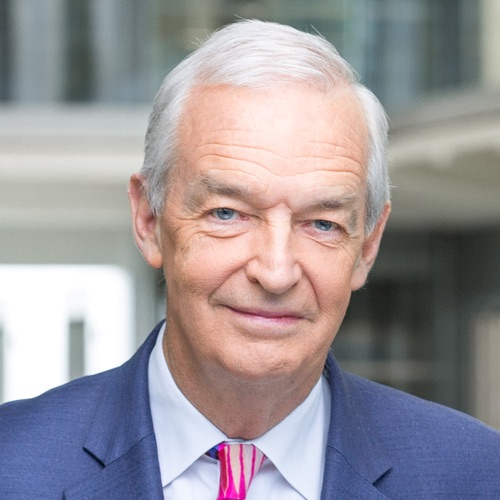

Follow @jonsnowC4 on Twitter.