So will the HBOS trio go to jail?

It was long, long ago, during the hay days of the last Tory administration, someone thought of the wizard wheeze of de-mutualising Britain’s hallowed building societies. One of the great thrusters in the consequences of this great enterprise was James Crosby – Sir James, to you and me, and despite today’s parliamentary banking commission report, still Sir James.

Crosby oversaw the construction of HBOS – a fusion of the now “liberated” Halifax Building Society and a bank further north in Edinburgh. Crosby had been chief executive of what had become the Halifax Bank. He it was who merged the bank with the Bank of Scotland. For his troubles he secured that knighthood.

To crown the enterprise Sir Dennis, soon to become “Lord” Stevenson, was secured to become the chairman of HBOS. Stevenson was already a director of numerous other companies and chairman of Pearson, prestigious owners of the Financial Times no less. Make no mistake, Stevenson was an establishment man – cross party, and with access to any boardroom or dinner table he wanted to attend.

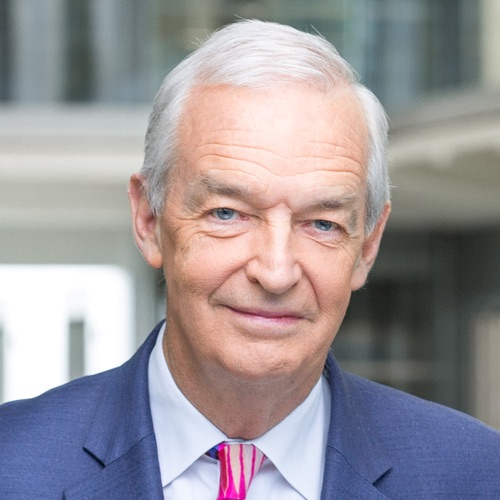

(Sir James Crosby, Andy Hornby, Lord Stevenson)

(Sir James Crosby, Andy Hornby, Lord Stevenson)

Smooth, confident, and yet a self-confessed depressive, Stevenson made his way too in both charitable and arts sectors. He was a key fundraiser for the building of Tate Modern. Despite all this, he was apparently able to spare three full days a week to chair and oversee HBOS – at some £800,000 a year plus bonuses (reportedly in the millions).

Crosby and his cohorts grew the bank at what proved to be a catastrophic rate. Whistleblower Paul Moore began to blow like hell. A senior finance officer in the bank, Moore recognised that if the bank kept going at this rate, it would go bust – he told the board so repeatedly from 2004 onwards. A respected firm of City accountants was brought in to check if he was right. Moore was moved and then sacked for his pains. But Paul Moore could have written today’s report himself.

Here’s the exciting bit. The banking commission says Stevenson, Crosby, and subsequently Andy Hornby, ran the bank so badly that it would have gone bust even without the global financial meltdown in 2008. So what happened? The regulator, the FSA, appoints Crosby to its own board in 2004, just as HBOS is running wild.

Indeed when the whole HBOS enterprise is running out of control altogether, the FSA make Crosby their deputy chairman. He only resigned in 2009 after his bank had to be rescued by Lloyds TSB in a shotgun marriage that resulted in you and me having to bail it out to the tune of £32bn. No wonder today’s report castigates the FSA for being asleep at the wheel.

Will there be an investigation into anyone’s dereliction in public office? You bet there won’t be.

Crosby retains his £570,000 pension, which you and I are effectively supporting. Stevenson still enjoys several homes and the consequences of vast monies earned in the course of bankrupting a British bank.

So, will anything be done? Will any of these people ever be brought to book? Will “Lord” Stevenson continue to enjoy the terraces of the House of Lords?

The record thus far – with the least establishment-connected operative of HBOS, Peter Cummings, the only HBOS director barred from the City – suggests not a lot will happen.

It’s been like this for generations. For some strange reason, the City of London, and the British banking system in particular, is a prison-free zone, and there’s no sign that either the coalition government or the opposition are ever going to change it. So shall we get used to it, and keep paying our taxes!

Follow @jonsnowC4 on Twitter.