The human cost of banking misbehaviour

Alan Henderson’s dad was a simple window cleaner. He started a small business in Putney, South London, doing just that. Alan joined as a boy and started mending broken windows. One day he had this bright idea of making ‘For Sale’ signs and other small advertising boards.

Perhaps it’s not surprising that today his small business is also making placards for www.bully-banks.co.uk – the activist outfit that has pushed the Financial Services Authority into blowing the whistle of the widespread mis-selling of a financial product known as an Interest Rate Swap Agreement or IRSA.

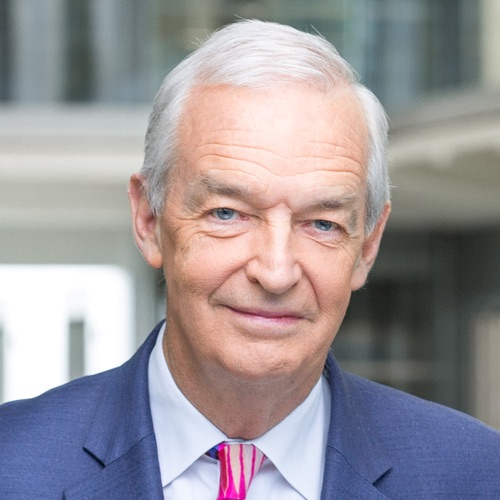

I am up to my neck in scandalous banking misbehaviour making a Channel 4 Dispatches called “Can you Trust Your Bank”. That’s how yesterday I found myself in the yard of a small business – Henderson Signs in South London that has been blighted by bank’s mis-selling.

When Alan grew the business in the 1970s he knew his bank manager well enough to call him Harry. Alan would ask for a loan to expand his small family business; Harry would check it out and 24 hours later would lend him the money. Alan would pay the interest, make the profit, and pay back the bank.

Today Alan’s banker is a faceless voice on the phone demanding money. Five years ago Alan was persuaded by the bank to take out an IRSA when he got a £1.7 million loan to expand his business further. Alan says the ramifications of taking one on – and the potential risks – were not explained to him. IRSAs were sold as protection – or to act as a hedge – against a rise in interest rates and are now the focus of the FSA’s mis-selling ruling.

Alan is 73 and intended to retire a few years back but when he and his cancer stricken wife Margaret (73) realised what their loan was costing them they both had to return to work full time. The bank was suddenly demanding a staggering £32,000 a quarter for a product they never understood.

When they tried to end it, the bank said it would cost them an ‘exit fee’ of £400,000 to abandon it. Today they have paid more than that already merely service the IRSA

Alan and Margaret were close to tears as they told me how frightened they were of telling anyone what had happened. They thought they were the only people in the world to fall for such schemes sold by banks. It wasn’t until they met hundreds of other victims on-line that their lives began to recover hope.

Since the FSA is still ruling on their case, the bank has been unable to tell them anything. They are due yet another £32,000 payment in August.

Their story is just one facet of bank behaviour which is under such intense scrutiny at the moment. Somewhere along the line the bond of trust between banks and their customers – large and small – has been broken.

PPI mis-selling, interest rate swaps, excessive pay and bonuses and now the Libor scandal are all milestones in this story.

I hope you will join me to watch Channel 4 Dispatches on Banking – 8.00pm on Monday 23 July.

Join the conversation on Twitter #snowbank

Follow @jonsnowC4 on Twitter.