Pain and pity for the waning glory of Greece

A gorgeous country, engaging people, rewarding cuisine, and the richest remnants of its own history of any country on earth.

Yes, Greece has it all – at one level. At another, it boasts some of the most corrupt people in influential places and some of the worst structures of governance and civic observance on the continent of Europe.

None of what I have said is new. All of it has both predated, and endured during, Greece’s relationship with Europe and with the eurozone.

Brussels knew perfectly well how Greece worked and didn’t work, just as the Eurocrats and the councils of ministers knew how Spain and Italy worked and didn’t work.

And yet Greece has become the tottering workbench upon which Europe struggles to sort its future, its present and its past. It surely must have been obvious to the founding fathers of both the European Union and the eurozone, that a country like Greece would take very much longer and would prove much more expensive to hoist into the European family than, say, Holland or the UK.

It’s one of the reasons de Gaulle said “non” to Britain’s EC membership in the beginning. The UK would have proved a far too powerful and successful a competitor for both the vision and power inside a Europe that was still recovering from the ravaging of wars.

When it came to Greece, decades later, there was no threat, either in terms of vision or power. “Have her in,” came the cry. And she was – not only into the EU, but eventually the euro, too.

Leaving Athens this morning I felt pangs of both pain and pity. For whilst Greece is an agent of her own tragedy, she is powerless to do anything to resolve it. The power – and presumably the elusive vision – is in Brussels. I believe Greece outside Europe or even the euro will trickle away into becoming, for a time, a third world nation.

Further, that this can only be avoided if the eurozone does indeed become a coherent fiscal and political union. Angela Merkel sees this. There are others, too. Spain, Portugal, Ireland and Italy see it – France and Britain less so.

If Greece is to be “saved” in her European form, she will be saved by decisions taken in Brussels, not Athens. And those decisions will be taken eurozone-wide to cohere all euro members in the nearest thing to a federal system.

That new eurozone will harmonise tax systems, regulate and order the banking sector, and limit the size of sovereign budget deficits. It might happen. If it does not, the demolition of Greece will prove the first casualty of the death of the European single currency.

It is a demolition that will take more than a generation to recover from, even if then. Hence that sense of pain and pity as I looked down from my jet plane window on the retreating hills and temples of beloved ancient Greece.

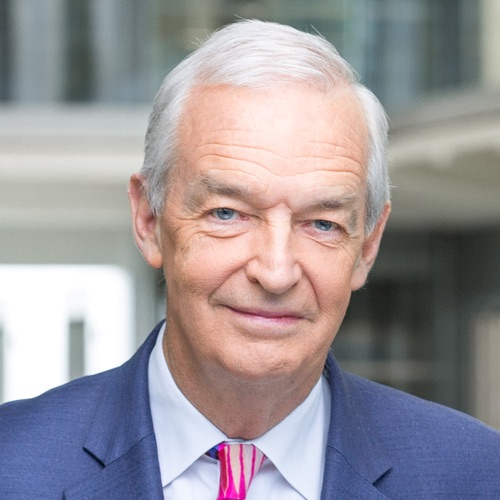

Follow Jon Snow on Twitter