Freeze public spending, cut taxes – Liam Fox’s economic plan

As Liam Fox becomes the latest senior figure to offer his solution to reviving the lacklustre economy, Channel 4 News looks at some of the other suggestions for curing Britain’s woes.

The former defence secretary knows how to pick his moments.

With just nine days left before the chancellor sets out the budget, Liam Fox has urged the government to freeze public funding for at least three years and use the money to pay off the deficit and introduce tax cuts.

The government has ring-fenced spending on schools, foreign aid and the NHS. But according to Mr Fox, this is unsustainable. Instead, with the estimated £345bn saved, the government should cut taxes, including the scrapping of capital gains tax and tax on pensioners’ savings.

“The great socialist coup of the last decade was making wealth an embarrassment,” he said. “It is not. Wealth is the prize for aspiration and hard work, and its side-effects are higher tax revenues, more jobs and more investment.”

The great socialist coup of the last decade was making wealth an embarrassment. It is not. Wealth is the prize for aspiration and hard work. Liam Fox

Mr Fox’s speech in London at the right-wing think tank, the Institute of Economic Affairs, unashamedly broke ranks with senior Tories, but echoes the concerns of some Conservative backbenchers.

“We need to begin a systematic dismantling of universal benefits and turning them into tax cuts,” he added, crediting a period of “socialist” rule for the national debt.

Mr Fox’s proposal was met with an a metaphorical brick wall at Downing Street, which repeated David Cameron’s intention to stay the course.

However Monday’s plan is just the latest alternative economic proposal in the lead up to budget day – and a sign of increasing pressure on Chancellor George Osborne, following the downgrading of Britain’s prized AAA credit rating.

In the run-up to budget day on 20 March, Channel 4 News looks at some of the alternative economic policies being proposed.

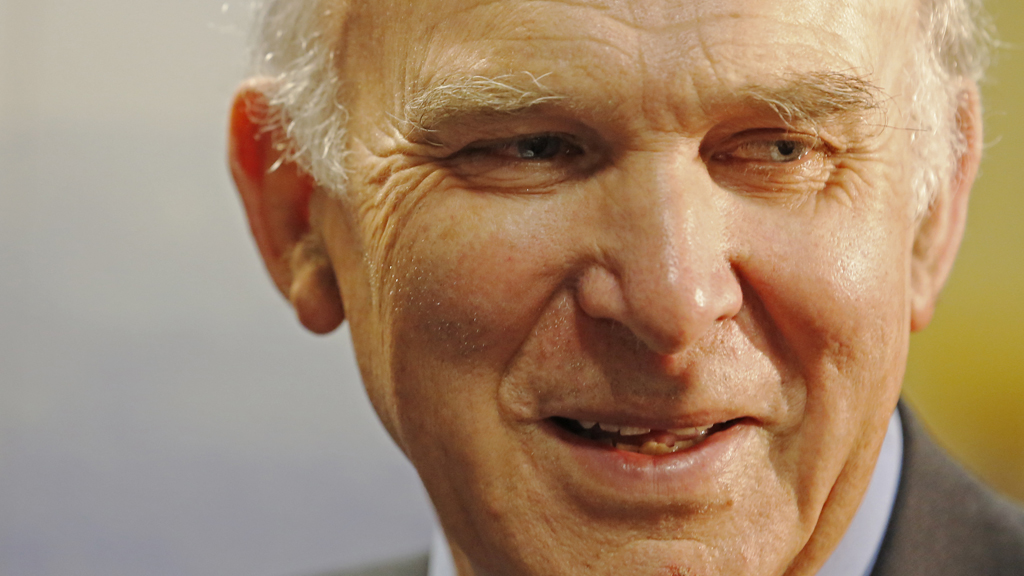

Vince Cable: capital spending

Business Secretary Vince Cable called Mr Fox’s proposal a “jihad” against public spending.

But only last week, the senior Liberal Democrat issued his own manifesto in a wordy New Statesman article, which happened to be published on the same day that Mr Cameron gave his own speech on the economy.

In a sign of his new preferred emphasis on spending to boost the economy, he wrote: “Any reliable escape route from the crisis has to have a plausible mechanism for boosting credit to business, especially SMEs.”

Mr Cable said that the “balance of risk” had changed between deficit reduction and growth, and that the government should reconsider its austerity measures.

Instead, borrowing more to finance the building of schools and houses could kick-start growth – a move hailed by Labour as a sign that Mr Cable was “at last seeing sense” and backed by the Lib Dem Lord Oakeshott.

Ukip: flat-rate tax

On the other hand Ukip, whose free-market economic policies have been dubbed a “a hard-right wet dream” by the Independent, have called for tax cuts to solve the country’s economic ills.

The party’s solution for Britain is a flat tax rate of 31 per cent for all, except for those on minimal incomes. Similarly to the campaign group The Taxpayers’ Alliance, they want to scrap national insurance as well as subsidies for renewable energy.

Green Party: tackle private, not public, debt

The Green party, unsurprisingly, puts sustainability and environmental priorities at the centre of its policy. Caroline Lucas recently pointed out that while public debt is at 70 per cent of GDP, private debt is at 420 per cent.

“A massive overhang of private bank debt goes a long way to explain why banks are not lending and why private sector investment is stalling,” she said at the IEA.

The party has called for a separation of retail and investment banking – a move which Mr Osborne has threatened if they fail to enforce a ring-fence – and a limit on the size of Britain’s banks.

To reduce public debt, it has also called for a programme of “productive investment” aimed at retro-fitting Britain’s older houses, increasing energy security and reducing energy bills – all of which would be financed by loans from the Bank of England.

China: ‘work harder for longer’

China is faring better than most at keeping the recession at bay. And Jin Liqun, chairman of China’s sovereign wealth fund (China Investment Corporation) had a relatively straightforward message for Europe and the UK when he last spoke to Channel 4 News.

He said that the labour laws in Europe, and the UK, are “sloth inducing” and that any attempts to reduce debt will only go so far if the limit to working hours remains.

“The root cause of trouble is the overburdened welfare system, built up since the second world war in Europe – the sloth inducing, indolence inducing labour laws,” he told Economics Editor Faisal Islam.

All of which puts Liam Fox’s “radical” proposals in context.