The Chancellor, Rishi Sunak, announced this week that corporation tax – which businesses pay on their profits – will go up from 19 per cent to 25 per cent in 2023.

It’s a massive change in tax policy – the first time a UK chancellor has raised the headline rate of corporation tax in decades.

But Mr Sunak insists that the UK “will continue to be an internationally competitive country”. Is that true?

The analysis

Mr Sunak said in his speech: “Even after this change the United Kingdom will still have the lowest corporation tax rate in the G7 – lower than the United States, Canada, Italy, Japan, Germany and France.”

This is true, but it doesn’t tell the whole story.

The Institute for Fiscal Studies (IFS) explained why in their budget analysis today.

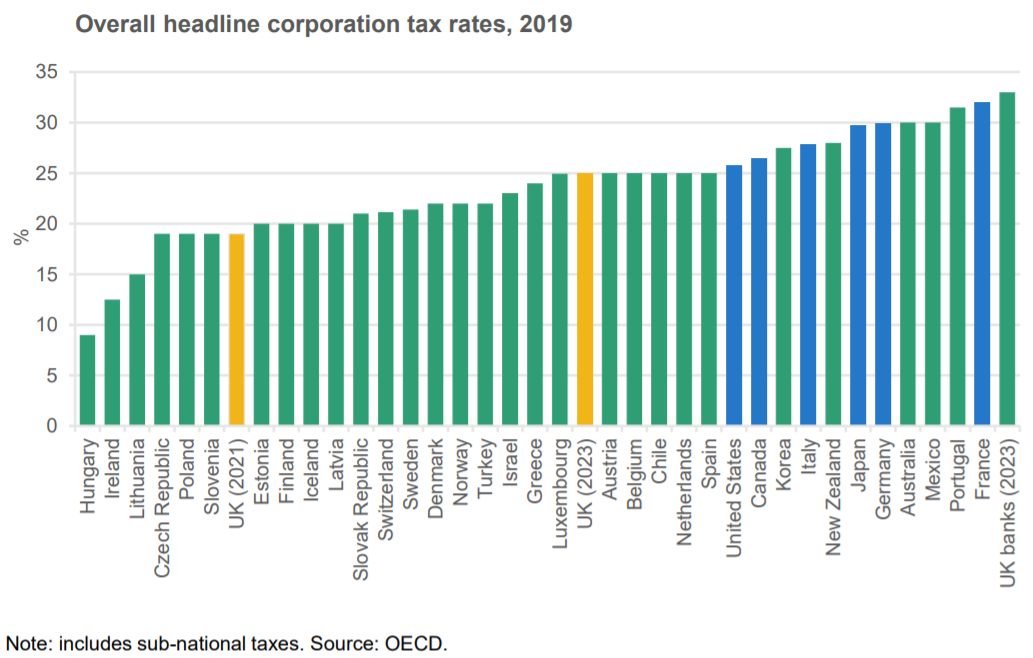

This is how Britain’s headline tax rate compares to the other members of the OECD group of developed countries:

Moving from 19 to 25 per cent (the two yellow lines) would put the UK right in the middle of the pack.

It is fair to say that the six other members of the G7 group of major advanced economies (in blue) would still have higher headline corporation tax rates.

Effective tax

The IFS also points out that while the headline corporation tax rate is important, there are many other rules that affect how much tax companies really end up paying.

The definition of taxable profits changes between tax jurisdictions, and some countries are more generous than others in allowing business to do things like writing off investment costs against tax.

Tweaks to these rules means the UK “effective tax rates are higher relative to other countries”, said Stuart Adam from the IFS.

It helps to explain why Britain has continued to collect fairly high amounts of corporation tax over the decades, even while cutting the headline rate.

The UK raises already raises more revenue from corporation tax as a share of national income than the OECD average, and this will rise in the coming years.

But of course, other countries could follow suit in raising their corporation tax rates too, so these league tables might look very different in 2023.

If that happens, it will mark a significant change in global trends in public finance.

For decades, many countries all over the world have been cutting corporate tax rates in a bid to attract business.

Mr Sunak’s decision to reverse this trend in Britain could be an early sign that this international competition – which tax campaigners often criticise as a “race to the bottom” – may be coming to an end.

The verdict

It’s true that Britain will still have the lowest headline rate of corporation tax in the G7 group of major advanced economies in 2023 even after Rishi Sunak’s hike, assuming other countries do not change their rates.

But the move will put the UK in a middling position relative to all the other nations in the larger OECD group.

Britain’s effective corporation tax rate and the amount it collects from businesses is already higher than the low headline rate would suggest.