A rash of recent articles has blamed foreign property investors for apparently killing the atmosphere and creative spirit of certain London neighbourhoods.

Writing in the Telegraph, nightclub boss Alex Proud laments the death of Cool London and writes that “ultra-prime central London is fast becoming a ghost-town where absentee investors park their wealth”.

This echoes other articles that claim the capital is now home to hundreds of mansions left to rot by investors who are only interested in trading properties as assets, not living in them as homes.

Other reports have suggest that very large numbers of new overseas buyers are dominating the London property market, inevitably making housing less affordable for local people.

It’s a compelling narrative, but what are the facts?

Foreign investors

London estate agent Knight Frank did some research on foreign investment in the capital’s new-build property sector last year.

The first problem they highlighted was how you define “foreign”. Born in another country? Well, that covers nearly 37 per cent of the population of London, if you go by the 2011 census.

It makes a big difference if you filter people by place of residence rather than birth.

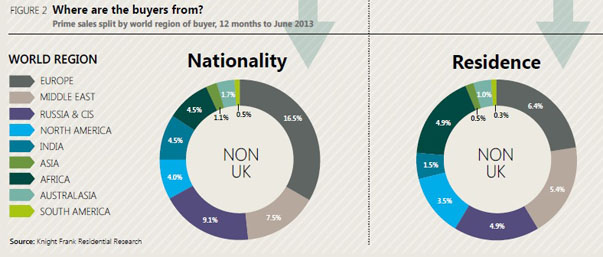

Knight Frank found that in the 12 months to June 2013, 49 per cent of sales of properties worth more than £1m in prime central London locations went to people born outside the UK.

But only 28 per cent of buyers were investors not resident in the UK.

Despite the myth of Russian oligarchs buying up the best addresses in central London like Monopoly pieces, Knight Frank found that only 9.1 per cent of the buyers of these high-end properties were born in Russia and the CIS and 4.9 per cent were residents of those countries.

Another big estate agent, Savills, has produced its own very detailed analysis of who buys what. Arabs and Russians are the big spenders, while buyers from China and the far east prefer small high-rise riverside flats.

There’s no doubt that there is a lively overseas trade in London property. But most of this foreign investment activity takes place within a very-small sub-market of properties in prime central locations.

Widen the focus outside that narrow band of very expensive properties, and the proportion of overseas investment falls.

Across greater London as a whole, there is evidence that between 85 and 90 per cent of new-builds go to UK-born buyers.

Research from Savills on resales, rather than new builds, in the prime central London areas, does find an increase in foreign-born buyers in recent years.

But these are not historically high levels of overseas ownership. The 2012 figure of 38 per cent is the same as the 1990 level.

And this percentage is almost exactly the same as the proportion of Londoners who were born in a foreign country.

Lights out?

Commentators have spoken of whole central London streets looking deserted after dark, the suggestion being that houses are bought purely as investment assets and left empty while their prices (hopefully) appreciate.

The Evening Standard commissioned some research earlier this year that found 740 uninhabited propertes across the capital worth £5 million or more.

The newspaper pinpointed one London street, The Bishops Avenue near Highgate, north London, where 15 grand houses have been left to rot, some for decades.

These are headline-grabbing examples, but there is some evidence that this may not be a widespread problem.

Research from Savills, and the industry body, the Home Builders Federation, found that about 85 per cent of new-build sales in the most expensive areas are used as main residences or are let out (so not empty). Across the whole of London the occupancy rate is “considerably higher”.

Housing bubble?

Pundits are wondering whether foreign investment is driving a recent rally in house prices, particularly in London and the south east, forming a bubble that will eventually burst.

Others say this is not so much a bubble as a market correction, with prices still yet to return to their pre-crash levels.

There is some support for this in the longest house price data series we have, collected by Halifax.

Search for “historic house prices” online and you find any number of graphs that appear to show a dramatically steep rise in recent years. But these ignore inflation and so present a totally distorted picture of the real change in the market.

Halifax’s UK-wide house price figures, which are adjusted for inflation using 1983 prices as the benchmark, paint a quite different picture.

Across the country, it’s clear that prices have been rising over the last few years, as has the ratio between the average price and average earnings (the benchmark here is the average male full-time salary).

But the average property price and the average price-to-earnings ratio are still well below the pre-crash peak. In fact, things are about the same as they were in 2003.

Regional figures are not as detailed, but Halifax data also shows that the average London property is also still below its 2007 peak.

Creative destruction?

The idea that people doing creative jobs have been priced out of the market in inner London is a difficult one to quantify. For a start, exactly which demographic are we talking about?

In response to Alex Proud’s article, Savills researcher Neal Hudson had a stab at tracking the pace of gentrification, marking the changes between the 2001 and 2011 censuses in people who work in the culture, media and sporting sectors.

His findings back the thrust of the article: the number of people doing creative jobs has plummeted in prime central London boroughs like Kensington and Chelsea and Hammersmith and Fulham.

But the boroughs with the highest rise in these (arguably) “cool” jobs are Hackney and Tower Hamlets – part of inner rather than outer London. And Islington – singled out as a hotbed of gentrification by Mr Proud – has actually seen a slight rise in its creative population.