The claim

“I believe what we have done with this document is to set a new gold standard for how manifestos in this country should be produced.”

Nigel Farage, 15 April 2015

Nigel Farage famously described Ukip’s last general election manifesto as “drivel”.

This time there was a ringing endorsement from the leader of the party’s programme for government.

Mr Farage said Ukip would preside over an £18bn tax giveaway, a “low-tax revolution” that will “unleash a kind of economic dynamism that has not been seen in this country for a very long time”.

Ukip say their manifesto is fully costed, unlike the other parties, and they have commissioned independent economists from the Centre for Economics and Business Research (CEBR) to approve the numbers.

The analysis

Ukip have published CEBR’s “economic review” of selected policies alongside their manifesto.

As far as we know this is indeed the only manifesto whose numbers have been checked by a respected independent think-tank.

And it’s probably fair to say that there is more detail about how certain promises will be paid for here than in the manifestos of the other major parties.

But it’s important to be absolutely clear about what CEBR have and have not done for Ukip.

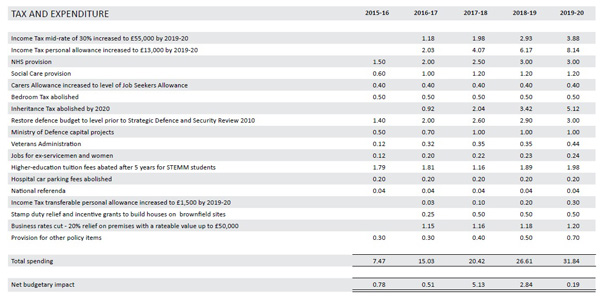

The think-tank has been tasked to look at some of the ways Ukip say they will save money, including leaving the EU, slashing foreign aid and scrapping HS2 …

…and some of the things they want to spend money on, like free hospital parking, tax cuts and a bigger military budget:

CEBR conclude that the estimated numbers in each case are “sound and reasonable”, so it’s reasonable to assume the savings really will cover the tax giveaways and additional spending.

It’s worth noting that the numbers in the manifesto don’t quite match some of the rhetoric Ukip have come out with recently.

Until very recently, the talk was of EU membership costing Britain £55m a day – about £20bn a year.

Now Ukip appear to have accepted that net membership fees are much lower. They expect to save £7.5bn to £9bn a year from 2017/18, accepting that it would take two full years to negotiate and make arrangements for withdrawal from the EU.

We were also supposed to save £2bn a year from making foreign visitors and migrants pay for using the NHS from health insurance. That has now been cut to £500m in the first year of a Ukip government, rising to £900m by the end of the parliament.

The bigger picture

CEBR has been asked to comment on the impact of selected policies here.

What they have not been asked to do is model the wider impact of Ukip’s biggest aspirations – pulling out of the EU and substantially cutting immigration. Both of these things could have a big effect on the future of the economy.

While it might be fair to say that Britain could save £9bn a year in EU membership fees, this is only one side of the equation. It does not take into account the potentially negative long-term economic effects of pulling out of Europe.

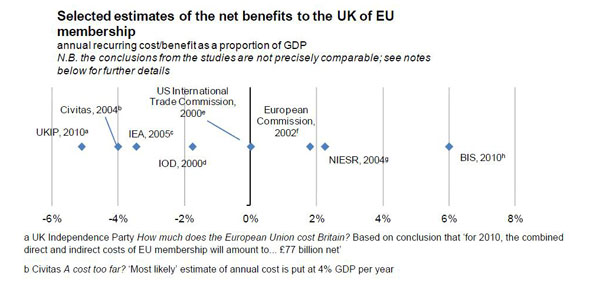

As we have found in the past, there is a broad spectrum of opinion on what how an EU pullout would affect Britain’s national wealth overall, and there is no official or definitive cost/benefit analysis of EU membership, though a number of people have tried to come up with projections (graphic – House of Commons Library):

In recent years some economists have warned that Britain’s GDP could fall slightly in the event of “Brexit” while other economists have disagreed, saying there would be a net boost to the economy.

The complexities of what would happen after an EU exit make it very difficult for anyone to be certain how trade would be affected.

As Channel 4 News’s economics producer Neil McDonald noted today, both Norway and Switzerland are outside the EU but still have to pay into its budget as a price for access to the single market.

Would Britain end up paying billions for similar trade privileges, or would we be in a stronger bargaining position, as Mr Farage believes? It would all be up for negotiation.

Similarly, while Ukip are stressing the pressure that high immigration puts on housing and public services, the net economic impact of migration is highly controversial too.

Mr Farage has ruled out putting a cap or target on net migration and there was no number mentioned in today’s manifesto. But he has said he would like to see the number of immigrants to the UK fall to below 50,000 a year, significantly below current levels.

The Office for Budget Responsibility explicitly linked higher net migration to higher growth in its most recent economic and fiscal outlook, and a string of studies have concluded that EU migrants are net contributors to the economy.

(In fairness, Mr Farage has been challenged on this point and has said immigration should be controlled anyway as “some things are more important than money”.)

Nothing published today by CEBR contradicts this. The think-tank has not been asked to produce an overall cost/benefit analysis of a “Ukip Britain” outside the EU and has not attempted to do so.

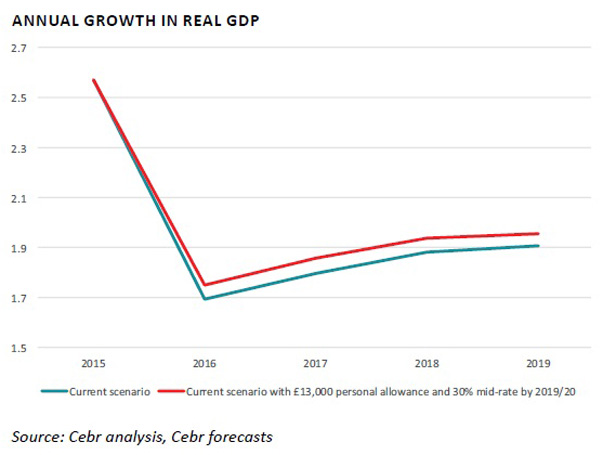

It should also be noted that the CEBR graph predicting higher economic growth…

… refers only to the plans to cut income tax that Ukip unveiled today.

It doesn’t mean that the CEBR expects the net impact of all Ukip policies to be higher growth.

The verdict

It’s probably fair to say that Ukip have provided more detail in their manifesto about how they would pay for some policies than the other major parties.

And as far as we know, they are the only party to have hired a reputable economics think-tank to check some of their numbers.

But the important word here is “some”. The CEBR review does not cover the whole potential economic impact of Ukip’s plan for Britain.

There are two massive policies – pulling out of the EU and cutting immigration – that fall outside the scope of CEBR’s analysis.

Mr Farage appears to think that both moves will save Britain money, but many economists disagree with him.

The some things are more important than money