Microsoft buy Skype for $8.5 billion

In a bid to keep up with rivals Apple and Google, Microsoft has made its biggest ever acquisition and added the internet phone company Skype to their portfolio.

The multi-billion dollar purchase comes despite Skype recording a loss last year and operating with over $600m of debts. It is also be Microsoft‘s biggest purchase in its 36-year history.

The company will become a new Microsoft division headed up by current chief executive, Tony Bates. Skype users will be able to link-up with Microsoft through Lync, Outlook and Xbox live and will support devices such as Xbox and Kinect.

Skype was sold by eBay to Silver Lake investment group for $2bn in 2009. The company was founded in 2003 and now has 170 million users worldwide.

A joint statement for the companies said of the deal: “The combination will extend Skype’s world-class brand and the reach of its networked platform, while enhancing Microsoft’s existing portfolio of real-time communications products and services.”

The takeover may be a reaction to the success of Microsoft’s rivals and their own video calling programmes. Although a video calling feature is available on Microsoft’s Windows Live Messenger service, it can only be used on PCs and laptops – not on the latest Microsoft mobile device or anything that uses the Windows Phone 7 software.

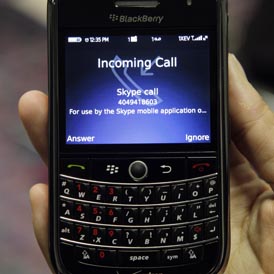

Skype was up until now unavailable on Microsoft mobile devices but available on all of their major rivals, as an app on iPod, iPad, Blackberry and Android phones. In addition, Apple’s Facetime programme and Google Talk have recently had their own success with consumers and usage levels have risen steeply.

Although it has a disposable spending power of $50bn in cash, Microsoft has long been worried about the success of its competitiors in the mobile market, having attempted to compete with music players, tablet computers and smart phones in the past.

Last year it joined forces with mobile giant Nokia as part of an aggressive attack on the mobile market in which Microsoft, despite good reviews for its products, only has a 2 per-cent share

It's not about tech, it's about extra eyeballs

Skype is, and was, more valuable an asset as part of a larger entity, writes Channel 4 News Technology Correspondent Benjamin Cohen.

Microsoft had its own pretty similar technology (Instant Messenger and Lync), so it's not about tech. It's about those hundreds of millions of extra eyeballs that Microsoft can seek to monetise.

It's about enhancing the experience of paid for Microsoft products such as Office, and it's about enhancing the fast-growing and crucially important Windows Phone division - although the latter might pit the tech giant against the mobile operators that buy Windows Phone handsets to give to users.

Buying Skype also made sense to Google and to Facebook but neither company needs the massive boost in "cool" that Skype brings to Microsoft.

Big money deals – big winners, big losers

In the last decade there have been a number of major deals and acquisitions in the online and mobile market, all with huge speculative price tags and some that resulted in bigger losses and even resale or closure.

MySpace purchased by NewsCorp for $580m in 2005 – NewsCorp currently seeking a buyer for around $100m. Bebo sold to AOL for $850m in 2008 – rumoured resale for under $10m. Friends Reunited purchased for £175m in 2005 – sold to DC Thomson in 2009 for just £25m. Flip camera was sold to Cisco for $590m in 2009 – Cisco announced in April 2011 that it was ending this area of the business, announcing 550 job cuts. AOL purchased by Time Warner for $166bn in 2001- now valued 98.7 per cent lower than at its highest level in 1999 at just $2.1 bn.