Payday lending crackdown: ‘tougher’ regulation outlined

Payday lenders will be forced to carry out affordability checks, and will only be able to ‘rollover’ loans twice, under plans put forward by the financial regulator.

The Financial Conduct Authority (FCA), which will oversee the consumer credit market from April 2014, has revealed the proposed clampdown on payday lenders.

Tougher regulation is coming and I expect them all to make changes so that consumers get a fair outcome. Martin Wheatley, FCA chief executive

Restrictions will also be placed on the number of recurring payments, known as continuous payment authorities, that payday firms are allowed to collect, following complaints that they are unexpectedly “draining money from borrowers’ bank accounts”

The FCA has also promised to ban any adverts that are misleading.

‘Ticking clock’

Martin Wheatley, chief executive of the FCA, said: “We believe that payday lending has a place; many people make use of these loans and pay off their debt without a hitch, so we don’t want to stop that happening.

“But this type of credit must only be offered to those that can afford it and payday lenders must not be allowed to drain money from a borrower’s account.

We welcome proposals to tackle unscrupulous payday lenders but we want the regulator to go further. Richard Lloyd, Which?

“That is why we’re imposing tighter affordability checks, and limiting the use of rollovers and continuous payment authorities.

“Today I’m putting payday lenders on notice: tougher regulation is coming and I expect them all to make changes so that consumers get a fair outcome. The clock is ticking.”

‘Unscrupulous’

Payday lenders have sprung up increasingly since the start of the UK economic slump. The sector is now estimated to be worth £2.2bn and there were an estimated 8.2m loans taken out in the 2011/2012 financial year.

Charities have reported increased number of people complaining about payday lenders, and the wholesector is being investigated by the Competition Commission.

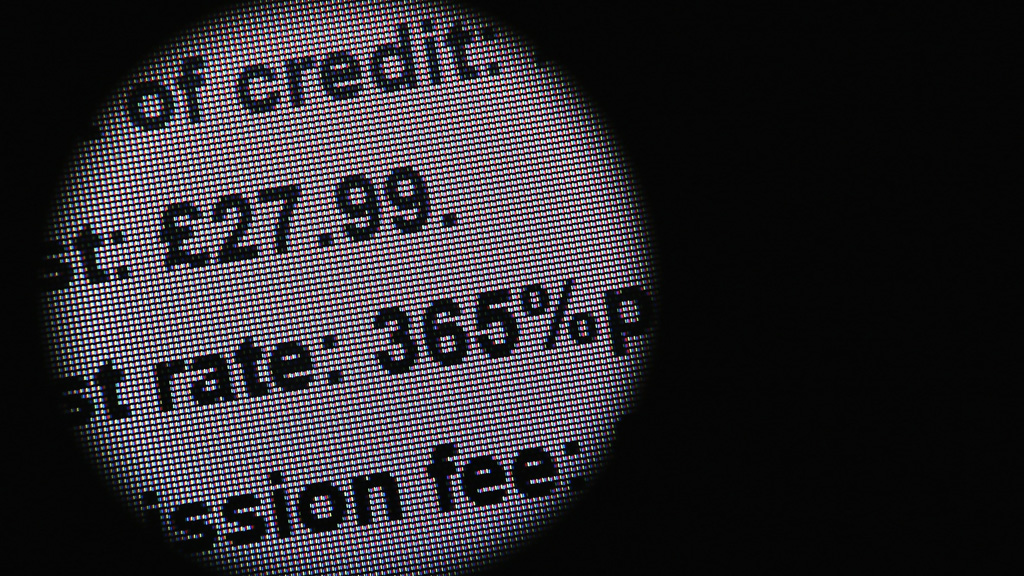

Wonga, the largest lender, gave out 3.8m loans in 2012, and quotes 5,5853 per cent APR. According to Which?, 46 per cent of people who take out loans use the money to buy essentials like food or fuel.

The government should be shame-faced it’s taken this long. Martin Lewis, MoneySavingExpert.com

Richard Lloyd, executive director of Which?, said: “Our research shows millions of people are increasingly reliant on high cost loans to pay for essentials or to repay other debts, so it’s good to see the Financial Conduct Authority planning to take tough action to clean up credit.

“We welcome proposals to tackle unscrupulous payday lenders but we want the regulator to go further and use its full powers to clamp down on problems faced by struggling consumers across the credit market, like sky-high penalty charges.”

‘Shame-faced’

Martin Lewis, founder of consumer help website MoneySavingExpert.com, said: “Parasitical payday lenders have taken over our high streets in the last five years.

“Our lax rules have made the UK a crock of gold and they’ve flooded in from across the world. For those of us who’ve been crying out for a crackdown, this hardcore regulation, while not perfect, is very welcome.

“Yet the government should be shame-faced it’s taken this long and even now it’ll be next year before the FCA has the authority to make this work.”