Richmond tops bill for council tax payments

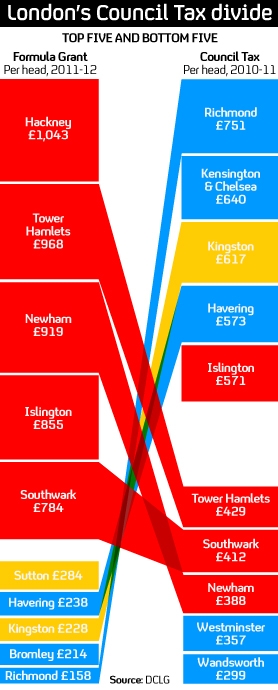

New figures from the Communities Department confirm that the wealthier your area, the more likely you are to pay high council taxes and to receive less from central government.

New government figures show that the residents who pay the most council tax per head tend to live in the most affluent areas of the country.

Statistics released yesterday by the Department for Communities and Local Government (DCLG) show that in 2010-11, residents in the London suburb of Richmond-on-Thames contributed the most – an average £775 per head.

The remaining authorities in the top 10 list of highest council tax bills per head are all in the south of England. The average per head bill for residents in those councils ranges between £734 (Chiltern) and £705 (Christchurch). The national average is £511.

By contrast, authorities with the lowest per head council tax bills include the urban areas of Manchester, Birmingham and Bradford.

Residents of the City of Westminster also pay low average council tax, despite the fact that the average price of a property in Westminster is significantly higher than in Richmond.

The average price of a City of Westminster property in the last quarter of 2010 was £848,264, while in Richmond-Upon-Thames it was £559,808.

Wandsworth, another London borough with high house prices (average price, Oct-Dec 2010: £473,691), has levied low local rates since the 1980s. In 2010-11 residents contributed an average per head council tax payment of £299, the lowest in England.

The DCLG has also released figures showing how much different parts of the country receive in central government grant, allocated according to a complex formula which assesses the extent of need in a given area.

The statistics place Richmond-Upon-Thames seventh on the list of authorities with the lowest central government average grant per head, at £158.

With the exception of Leicestershire, the remaining authorities in the top 10 list of authorities receiving the lowest central government grant per head are all in the south or south east of England.

Announcing the figures, Communities Secretary Eric Pickles said: “These new figures allow residents to go compare and see who really pays for local services.

“No-one likes paying council tax, given it doubled since 1997. But the richest and most affluent areas of middle England already pay the highest council tax.”

Tony Travers, local government expert at the London School of Economics, told Channel 4 News: “In the run-up to the local elections, it’s an attempt to remind people that this government, and Eric Pickles in particular, are trying to hold down council tax and avoid a revaluation, with all the pain and difficulty that would involve.

“In the run-up to the local elections, it’s an attempt to remind people that this government is trying to hold down council tax.” Tony Travers, LSE

“It also attempts to signal that Labour would not do such a thing.”

Council tax was introduced by John Major’s Conservative Government in 1993, replacing the unpopular Community Charge (dubbed the “poll tax” by critics). It codes properties according to one of eight bands, intended to reflect the property’s value.

Critics of the council tax system say that it is regressive because it fails to take account of the property-holder’s ability to pay.

Download the figures

Statistics provided by the Department for Communities and Local Government website

- Average council tax per head, 2010-2011

- Formula grant funding per head, 2011-12