Weakest necks in Europe? Britain’s ‘whiplash epidemic’

MPs and insurance companies say the increase in whiplash claims is to blame for the rise in motor insurance premiums – and make Britain the whiplash capital of Europe. Carl Dinnen reports.

“Get up to £1,000 cash advance and 100 per cent compensation” is the message on just one of hundreds of whiplash claim websites, incentivising people to claim for personal injuries.

But the House of Commons Transport Select Committee on Thursday said that the government should restrict the number of whiplash claimants by requiring them to provide much more medical proof of the extent of their injury.

The committee’s report into the cost of motor insurance also recommends that insurers be banned from selling details of their clients to lawyers, who can pursue their claim through the courts, all of which has led to rising insurance costs.

Jack Straw, the former justice secretary who gave evidence to the inquiry, said that whiplash is “not so much an injury, more a profitable invention of the human imagination – undiagnosable except by third-rate doctors in the pay of the claims management companies or personal injury lawyers”.

According to the committee report, there has been a 23 per cent drop in the number of casualties caused by road accidents over the last six years, which should result in a drop in car insurance costs.

But motor insurance injury claims for the same period have gone up by 70 per cent, from 466,000 in 2005 to 790,000 in 2010-2011, of which whiplash accounts for 70 per cent of claims, despite a lack of objective evidence.

Pain in the neck

Whiplash is a neck injury caused by a sudden jerk, such as stopping quickly in a vehicle. However NICE, the public health body which provides medical guidance to the government, has no formal diagnosis for whiplash. A spokesperson told Channel 4 News the government refers topics to the health body to look into, but had never asked about whiplash.

Thatcham, the motor insurance repair research centre, has researched vehicle seat design and how it can contribute to injuries.

It found that, despite a 70 per cent rise in whiplash claims, the manufacture of seat design has improved considerably over the last five years: the number of cars with “good” seat design – one that is less likely to contribute to whiplash – has risen from 16 per cent to 51 per cent. In 2010, only 9 per cent of cars had a “bad” seat design.

Criticism of ‘sharp practices’

Louise Ellman, the transport committee chair, said part of the problem is that drivers are persuaded to take legal action by lawyers who make cold calls, following up information they have bought from insurance companies.

Our customers are fed up of getting text messages, fed up of the compensation culture and have had enough of paying higher car insurance premiums to line the pockets of ambulance-chasing lawyers and claims management companies. Nick Staling, ABI

“The insurance industry must abandon sharp practices that push up premiums such as passing drivers’ personal data to other parties or taking secretive referral fees from solicitors, garages and car hire firms,” she said.

She added that insurers, solicitors and claims management companies are partly to blame: “They themselves [have] driven up the cost of motor premiums by encouraging people caught up in road accidents they did not cause to claim for personal injury, car hire, and other legal costs.

The major insurance companies welcomed the report, despite its criticisms of the industry. Nick Starling, director of general insurance at the Association of British Insurers (ABI), said that the bar to receiving compensation for whiplash is currently far too low.

“The committee is also right that the fees lawyers receive need to be reviewed as they currently add unnecessary cost,” he added.

“Our customers are fed up of getting text messages, fed up of the compensation culture and have had enough of paying higher car insurance premiums to line the pockets of ambulance-chasing lawyers and claims management companies.”

Referral fees

Draft legislation to ban referral fees relating to personal injury claims, is already going through parliament. The transport committee said the government should ensure greater transparency in all referral fee arrangements, not just when legal action is taken.

But Mr Starling said this did not go far enough, advising that all buying and selling of customers’ information should be “banned altogether”.

“That ban should apply to all organisations receiving them, not just insurers. Banning referral fees and, crucially, reducing legal costs will improve the situation for customers,” he added.

According to Mr Starling, Britain is in the grip of a “whiplash epidemic”, with one whiplash injury claim being submitted every minute.

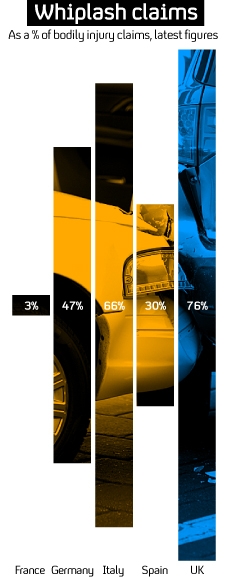

But is the problem unique to the UK? Figures from the European Insurance and Reinsurance Federation (CEA) suggest it is: in its most recent comparison of whiplash claims in 10 European countries, the UK comes out on top, with whiplash claims making up 76 per cent of total claims for bodily injuries.

In France, the figure is just 3 per cent, and in Finland, only 8.5 per cent. Italy is second highest, compared to the UK, with 66 per cent, and Norway comes in third, with whiplash claims making up 53 per cent of bodily injury claims.

A Ministry of Justice spokesperson said the department was already banning referral fees in personal injury cases, and reforming ‘no win no fee’ agreements to remove excessive litigation ncentives.

“We are very aware of the current concerns around the development of a ‘whiplash culture’ and the suggestions which have been made to make it more difficult for people to bring whiplash claims,” she said. “We will consider the Committee’s proposals very carefully in deciding the best way forward on this issue.”