Where can you get the UK’s cheapest – and priciest – petrol?

As the Bank of England meets to set interest rates, one of its main headaches is soaring petrol prices. Channel 4 News maps where you can get the cheapest, and most expensive, petrol in the UK.

Channel 4 News mapped the price of petrol in the UK before the Budget on 23 March, two weeks ago.

In the Budget, Chancellor George Osborne cut fuel duty by 1p a litre as a sop to disgruntled motorists.

But since then, at Britain’s most expensive pumps, petrol has already risen by almost 1.5p a litre – more than wiping out the Government giveaway.

The Chancellor also scrapped next month’s planned 5p per litre fuel tax increase – but experts warned that the ongoing strife in the Middle East could continue to push up the price of oil, and then petrol.

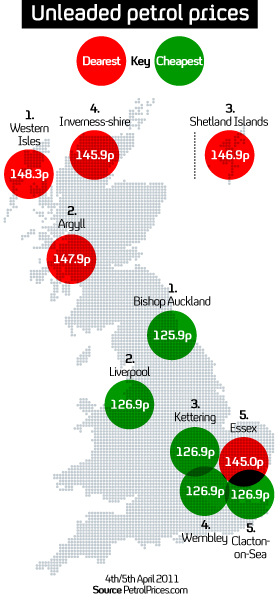

The graphic, left, shows the most expensive areas for petrol in the UK – and the cheapest, according to data from PetrolPrices.com.

For petrol at the bargain price of 125.9p for a litre of unleaded, you will have to get to Bishop Auckland, County Durham. This has actually fallen slightly since the Budget – down by 1p, in line with the Chancellor’s giveaway.

But if you are feeling the squeeze, it would be wise to avoid the Western Isles in Scotland – the United Kingdom’s priciest place for petrol, with one station charging 148.3p, a difference of 22.4p between the cheapest and most expensive.

Petrol prices and interest rates

The continuing rise in the price of oil is creating headaches for British consumers, but it also means problems for the Bank of England, writes Channel 4 News Business Producer Neil MacDonald.

Higher oil prices will tend to push up petrol and that leads to higher inflation. The Bank of England is due to take its next decision on interest rates this Thursday, and the obvious response to rising inflation would be to push up interest rates.

But at the same time, the rising oil price is eating into people's incomes - not least because for many families filling up the tank is an essential item which has to be paid for even if that leaves less money for other things.

So by reducing disposable income, the rise in the price of oil could reduce inflationary pressure in the UK in the long term. If that's true, putting up interest rates could make a bad situation worse by sucking even more cash out of consumers' pockets.

It's this dilemma that partly explains why the Bank of England committee which sets interest rates is split - three members want to raise interest rates now. The other six either want to leave interest rates on hold, or ease monetary policy even further.

And further rises in oil just intensify this argument - those who already fear inflation will see it getting higher and higher, while those who fret about the impact on our incomes will have more to worry about.

Of course, the price of oil might yet fall - but perhaps we shouldn't count on that. One man who has a huge amount of experience in this area is Sheikh Yamani - oil minister for Saudi Arabia for more than two decades.

He told Reuters that oil prices could leap to $300 a barrel if there is serious political unrest in his homeland. That hasn't happened yet, but its a sobering warning about the threat that oil could pose to Britain's weak economic recovery.